ETF Trading Strategies: Brazil and Taiwan Buck the Trend

Terrible employment data was nevertheless not as bad as feared, helping stocks rally early in the trading day on Friday.

Before taking a look at some exchange-traded funds that traders may want to keep an eye on over the next few days, I want to recap Monday’s ETF Trading Strategies column: “Bargains in Bonds and Bullion.”

In that article, I pointed to three exchange-traded funds that were significantly oversold and likely to outperform in the near term. Those ETFs were the iShares Barclay’s Aggressive Bond ETF

(

AGG |

Quote |

Chart |

News |

PowerRating), the iShares Barclay’s 20+ Year Treasury Bond ETF

(

TLT |

Quote |

Chart |

News |

PowerRating) and the SPDRS Gold Trust ETF

(

GLD |

Quote |

Chart |

News |

PowerRating).

Of these three ETFs, two are strongly higher as of Friday morning: TLT soared on Thursday, gapping up at the open and closing both above its 5-day moving average and in overbought territory. Both of these signs: a close above the 5-day moving average and a close in overbought territory (i.e., a 2-period RSI of more than 70) are signals that we use to exit stocks and ETFs bought on pullback.

Also higher was the GLD, which also provided traders with the same exit signals as of the Thursday close. Only AGG has failed to meet either of these two exit goals.

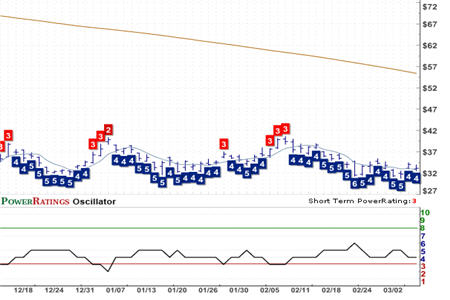

Turning to present and future potential opportunities, there are two exchange-traded funds that, as of the first few hours of trading on Friday, are again moving higher into overbought territory. Both of these ETFs – the iShares MSCI Brazil Index ETF

(

EWZ |

Quote |

Chart |

News |

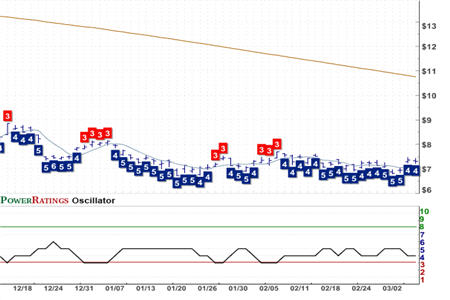

PowerRating) and the iShares MSCI Taiwan Index ETF

(

EWT |

Quote |

Chart |

News |

PowerRating) – rallied into overbought territory on Wednesday, along with a number of ETFs. However, as most of those ETFs continue to correct on Friday morning (such as the iShares MSCI Hong Kong Index ETF

(

EWH |

Quote |

Chart |

News |

PowerRating) and the iShares FTSE/Xinhua 25 Index ETF

(

FXI |

Quote |

Chart |

News |

PowerRating), both the EWZ and EWT are showing strength – and the possibility of once again closing in overbought territory below the 200-day moving average.

One of our primary ETF trading strategies over the past several months has been to sell short overbought ETFs. And as Larry Connors pointed out in a recent Trading Lesson, country funds often make up some of the best short term trading opportunities to the long side or the short side.

So for traders looking for opportunities in the current market, the bounces in Brazil and Taiwan ETFs are among those to watch for. Should these ETFs bound higher, they will certainly be among the ETFs and stocks that short term traders will see as most likely to reverse back to the downside.

Learn How to Trade ETFs! Click here to find out more information about our upcoming High Probability ETF Trading seminar next Friday led by TradingMarkets founder and CEO, Larry Connors!

David Penn is Editor in Chief at TradingMarkets.com.