ETF Trading Strategies: Last Short ETFs Standing

Stocks are off to a positive start, rebounding from Tuesday’s late sell-off.

There are three short ETFs with Short Term PowerRatings of 8 or higher in our Top 25 PowerRatings stocks roster. For traders looking to take advantage of increasingly overbought conditions below the 200-day moving average, these three short ETFs may be one good place to look.

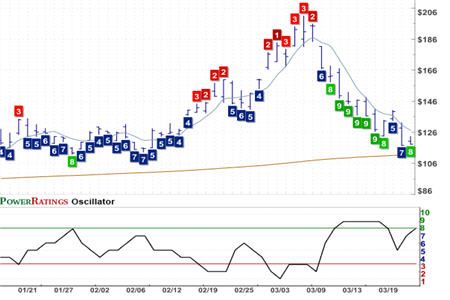

ProShares UltraShort Utilities ETF

(

SDP |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 9. RSI(2): 3.43

In much the same way that it can be psychologically difficult to buy stocks after they have pulled back by large margins and are potentially nearing their 200-day moving averages, we know as short term, high probability, mean reversion traders that this is precisely the trade to make.

While any one trade may or may not finish profitably, our research indicates that the edges for short term traders remain on the side of buying pullbacks rather than breakouts, new lows rather than new highs and weakness rather than strength. When the right stocks and ETFs are chosen – meaning those with high Short Term PowerRatings, low 2-period RSIs that are trading above their 200-day moving averages – these edges are pronounced and be a major part of any trader’s strategy for taking short term trades in this market.

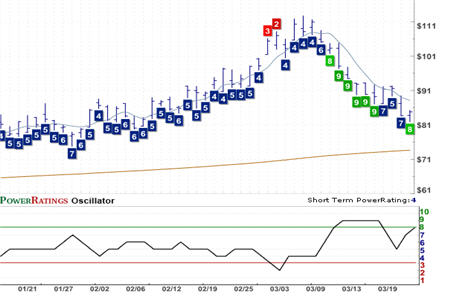

ProShares UltraShort Consumer Goods ETF

(

SZK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 26.07

In the first few hours of trading on Wednesday, SDP has slipped below its 200-day moving average, rallied back above that level, and continues to trade a few points above and a few points below the 200-day. The ETF has an extremely low 2-period RSI – one that would suggest strong potential for near-term performance if it were the RSI for a stock, to say nothing of an ETF.

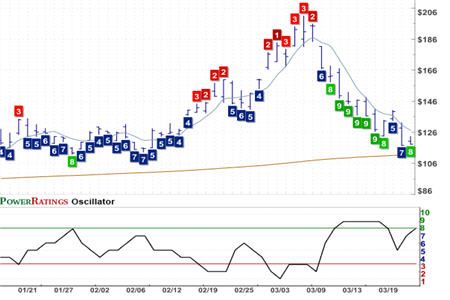

ProShares UltraShort Russell 1000 Value ETF

(

SJF |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 15.99

For its part the SZK is continuing to pullback Wednesday morning, losing a little over 3% as it continues to move lower. The drop has cut the ETFs 2-period RSI in half from over 26 to over 13, making the ETF an increasingly attractive potential target in the short term.

Lastly, SJF has actually rebounded from yesterday’s closing levels and now has a higher, rather than lower, 2-period RSI. This makes SJF less attractive as a potential trade right now. Traders considering a trade in SJF should wait for renewed selling, a Short Term PowerRatings upgrade or lower RSI values in the next few days before committing capital to what is right now no-longer oversold ETF.

Learn How to Trade ETFs! Click here to find out more information about our upcoming High Probability ETF Trading seminar this Thursday led by TradingMarkets founder and CEO, Larry Connors!

David Penn is Editor in Chief at TradingMarkets.com.