ETF Trading Strategies: Short ETFs in the Spotlight

Stocks are off to a positive start on Thursday, with the Nasdaq in particular leading the way higher.

A number of short ETFs that we have watched over the past several months: the ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating), the ProShares UltraShort Technology ETF

(

REW |

Quote |

Chart |

News |

PowerRating), ProShares UltraShort Oil & Gas ETF

(

DUG |

Quote |

Chart |

News |

PowerRating) – have all been trading below their 200-day moving averages. On an anecdotal basis, in terms of thinking about our overall trading strategy, the fact that ultra short ETFs tracking the three areas from which the markets will require significant leadership in order to continue advancing have entered (or re-entered) bear market territory below the 200-day moving average is something worth watching.

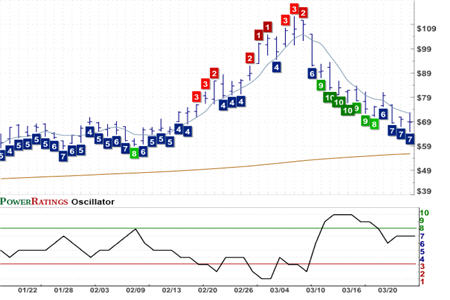

ProShares UltraShort Russell 2000 Value ETF

(

SJH |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 33.65

There remain, however, a number of short ETFs that have moved down significantly over the past several days in pullbacks that have brought many of them to within whispering distance of their 200-day moving averages. And up to and until these short ETFs actually close below their 200-day moving averages, we will continue to look at these funds as providing potential opportunity for short term trades.

A large number of these short ETFs have Short Term PowerRatings of 7. While 7 is a respectable, if not high, PowerRating, we do not really become interested in a stock or ETF until its PowerRating is upgraded to an 8 or better.

ProShares UltraShort S&P 500 ETF

(

SDS |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 29.58

This is why our trading strategy for the short ETFs in today’s report is more about watching than trading right now. It is possible that these ETFs will follow the SKF, REW and DUG below the 200-day moving average. Such a development would not only remove those short ETFs from consideration as trades to the upside (in the same way that we do not look to buy stocks below the 200-day moving average), but also would potentially signal higher prices for regular ETFs and stocks.

On the other hand, if we see the Short Term PowerRatings of these short ETFs tick upward to 8s and, even better, 9s, then we will have the statistical probabilities on our side should we decide to take positions in these funds.

ProShares UltraShort Industrials ETF

(

SIJ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 23.11

One note: although we are seeing some key ultrashort ETFs slip below the 200-day, we are not seeing ultra ETFs in general climbing above the 200-day. This means that, should we see continued higher prices in the markets, our trading strategy will likely shift in focus toward high Short Term PowerRatings stocks first and non-short, high Short Term PowerRatings ETFs second.

Learn How to Trade ETFs! Click here to find out more information about our upcoming High Probability ETF Trading seminar this Thursday led by TradingMarkets founder and CEO, Larry Connors!

David Penn is Editor in Chief at TradingMarkets.com.