ETF Trading Strategies: Using the RSI to Find the Best Edges

Stocks are at near breakeven levels early in trading on Thursday.

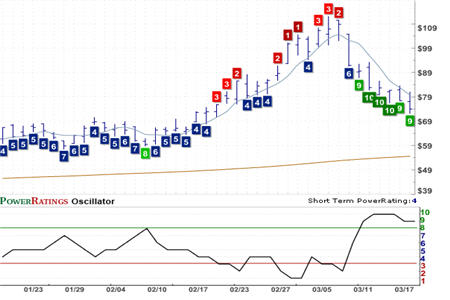

The continued rally in the markets has resulted in a sizable number of short or inverse ETFs with high Short Term PowerRatings of 9. Many of these short ETFs have made truly dramatic pullbacks over the past several days as a combination of short covering and risk-seeking have encouraged buying across indexes and sectors.

ProShares Short MSCI EAFE Index ETF

(

EFZ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 0.643

This has made some short term mean reversion traders a bit anxious about taking positions in many of these now, exceptionally-oversold ETFs. As I have noted recently – and as Larry Connors, founder and CEO of TradingMarkets has pointed out in his daily trading lessons – this anxiety is understandable.

Click here to subscribe to Larry’s free daily Trading Lesson of the Day newsletter

ProShares UltraShort Industrials ETF

(

SIJ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 0.696

At the same time, however, traders should be wary of letting their fear become an obstacle to what may be potentially good short-term trading opportunities – especially as the rally off the early March lows matures.

ProShares UltraShort MSCI EAFE Index ETF

(

EFU |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 0.744

Given the large number of short ETFs with Short Term PowerRatings of 9, how can short term traders choose those ETFs with the largest edges, those funds that are the most oversold and most likely to outperform when the inevitable profit-taking from the current rally sends stocks and markets lower – and short ETFs higher?

ProShares Short Dow 30 ETF

(

DOG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 0.757

Our preferred tool for gauging oversold conditions remains the 2-period RSI – and here is another instance when the 2-period RSI can help us spot the best opportunities for short term traders. By comparing the 2-period RSIs of all the 9-rated ETFs in our Top 25 PowerRatings roster, short term traders can tailor their ETF trading strategies to make sure that they are always buying the most undervalued, “on sale” ETFs available.

ProShares UltraShort Utilities ETF

(

SDP |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 0.855

Of the 19 9-rated ETFs in our roster, I’ve listed throughout this article the five ETFs with the lowest 2-period RSIs as of Wednesday’s close. Note that all five have 2-period RSIs of less than 1. Our statistics tell us that these are extremely low values for stocks, to say nothing of exchange-traded funds.

Did you know that our Short Term PowerRatings work for exchange-traded funds too? If you’ve been looking for help in trading ETFs in both bull and bear markets, then our Short Term PowerRatings may provide the solution you are looking for. Click here to start your free, 7-day trial today!

David Penn is Editor in Chief at TradingMarkets.com.