Forget fundamentals, the market’s in rally mode

Wednesday was what we

figured it would be… a day of rest. Price action held high ground

and in some cases new highs from there. Again, new highs for oil and nosebleed

levels for gold are irrelevant to stock market bulls: quit raising interest

rates and Dow 20,000 must be next. Right? We’ll see.

S&P 500 futures were tradable from the long side

for modest gains on at least two swings. A short fade off morning highs to the

daily pivot support was also valid. A 10pt total range, decent but muted action.

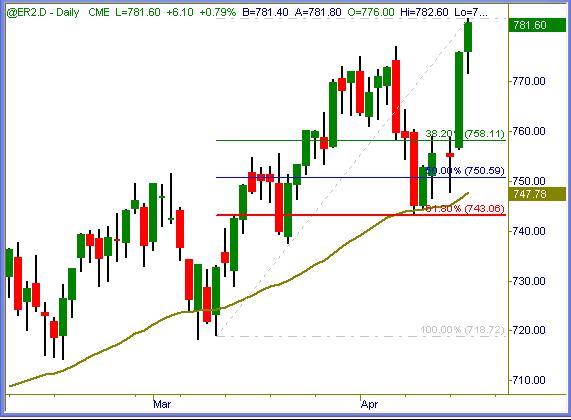

Russell 2000 futures held higher ground, did not

touch their pivot point for the second session in a row. That only happens in

the midst of strong trend-swing periods, of which this is one. Profits were all

on the upside swings, several long signals valid in this one too.

ES (+$50 per index point)

ER

(+$100 per index point)

ES (+$50 per index point)

Daily chart shows overhead congestion in the low

1320s. Between here and there is no man’s land. If those highs are finally

eclipsed for keeps, blue skies lie above.

ER

(+$100 per index point)

Small caps continue their unabated lovefest with

buyers. Every little dip finds new money pouring in… 100% bullish until proven

otherwise.

Summation

Forget about market fundamentals and all that stuff. Markets are in rally mode

with blinders on, oblivious to all else beside the pending end of interest rate

hikes. Once that event finally comes to pass, once the second FOMC meeting comes

where rates remain unchanged it remains to be seen how many stock buyers will be

left with money to burn. Until then, if the tapes keep pointing northward, there

is only one thing to do: buy the market. Successful trading is all about buying

strength and selling weakness on pull backs.

Today is cessation of trading for April index

option contracts. Likely to see some pinning action take place, along with

erratic spikes up or down. That can be especially true for the Russell 2000

contract, so beware of erratic gyrations potential.

Trade To Win

Austin P

(Online video clip tutorials…

open access)