Friday’s Five Pack: PowerRatings Stocks Ready to Rock

Yesterday’s sharp sell off seems to be a distant memory today as bargain hunters fight to stabilize stocks. Shares appear to be searching for a solid bottom despite a mixed and confusing Nonfarm Payrolls release this morning. The unemployment rate improved slightly by 0.3% but employers eliminated 20,000 jobs sharply more than the 5000 expected by analysts.

Index futures sold off hard prior to the report’s release but rallied back to better than break even near the open. The old saying in the market that investors should “sell the rumor buy the news” appears to be in full effect with this economic report. The selling which brings the buying is a classic representation of how we locate individual stocks for short term gains.

How do we go about finding stocks ready to move higher in the short term? Well, the cardinal rule is to only buy stocks that are trading above their 200-day Simple Moving Average. This simple fact prevents you from investing in a stock that is likely to continue its downward trend.

The next rule is only buy stocks on pullbacks not breakouts. I know this contradicts the common momentum based strategies taught all over the web and in many books. However, our extensive and statistically valid studies have proven that stocks that have fallen 5 or more days in a row, yet remain above their 200-day SMA possess increased odds of short term gains.

The next important characteristics, the stock should have prior to being considered, is the 2-period Relative Strength Index must be below 2. (for additional information on this proven indicator click here). This assures that the company is solidly oversold and attractive to bargain hunters and professional money.

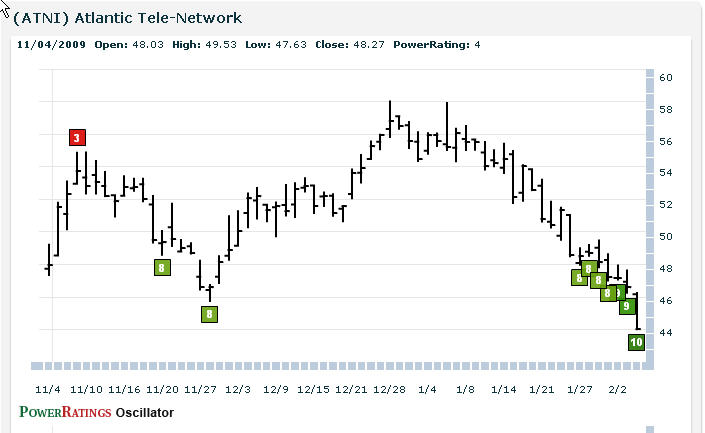

Finally, you need to look at the PowerRatings. The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term

Stocks that fit each of the above criteria have been proven to outperform their brethren by a statistically valid margin in the 1 day, 2 day and 5 day time frames.

Here are 5 names fitting the criteria for your consideration:

^BPFH^

^ATNI^

^HBHC^

^VOLC^

^DEAR^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.