Friday’s PowerRatings Five Pack

The two sharp sell offs this week have bred multiple bullish stock buying opportunities. Sharp pullbacks in share prices lead to the average investor panicking thus selling at the worst possible time.

This heard instinct is exactly what the professional trader capitalizes on. As the panic selling takes hold, the institutional money, savvy and professional investors lay in wait for the perfect time/price to start accumulating the stock at bargain prices. Nothing fundamentally needs to happen to the company to trigger this buying.

A positive fundamental event occurring after shares have sold off is icing on the cake. It isn’t what attracts the pros in the first place. Professionals and savvy investors look for bargains in stocks that are “oversold” technically. This means that sellers have simply run out of steam. It is within these oversold stocks that the odds of success provide a significant edge for short term gains.

The problem has always been exactly how to identify the overbought stocks most likely to bounce in the short term. We have developed a simple to use, 3 step system to help you locate these oversold companies.

Step 1. The stock needs to trade above its 200-day Simple Moving Average to be considered. This critical step works to assure that the stock isn’t in a death spiral by indicating a longer term uptrend remains in force.

Step 2. Look only at stocks whose 2-period Relative Strength Index RSI(2) is less than 2. Most traders use the standard 14-period RSI but our studies discovered that there was no edge at this setting of the indicator. While RSI(2) has proven to produce significant edge to the short term trader. (for additional information on this proven indicator click here).

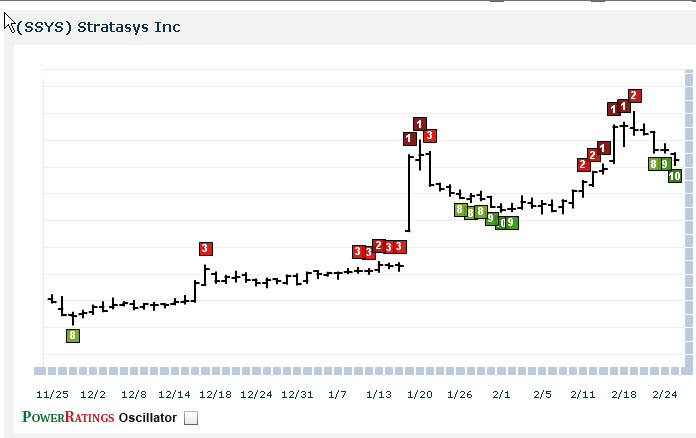

Step 3. Choose shares that have an 8 or above Stock PowerRatings. PowerRatings are built upon the study of 8.5 million daily trades. It is a ranking system of 1 through 10 with 1 representing the worse performers and 10 being the best performers. The system gauges stocks probability of outperforming against the S&P 500 over a 5 day period. Statistics clearly show that 1 rated stocks perform 5 times worse than the S&P 500, while 10 rated stocks outperformed 14.7 times the S&P 500 during the next 5 trading days.

Here are 5 names poised for short term gains:

^CAR^

^ALKS^

^GPOR^

^SSYS^

^RBCN^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.