Friday’s session could be very choppy

Thursday’s session posted some

straight-up price moves through much of the day, uncontested by selling of any

kind. The afternoon hours went sideways in rather choppy fashion, to be

continued this morning off the opening bell. With index option settlement

calculated in the first half hour followed by equity option expiry today, our

time here may best be served reviewing Thursday’s trade opportunities instead.

ES (+$50 per index point)

S&P 500 futures opened on a gap up, then

offered scalper sell signals from 1286+ down to 1284 lows. Not much distance,

but the +1pt ~ +2pt players had a few shots at the short side.

From there ES hit clustered support layers just

a couple of ticks above the daily pivot point. This was one of those moves where

it was near enough to qualify as a “touch”, but pure logistical stats run in

analytical mode would consider it a miss.

Absolute data and statistics in trading are

nice, but merely a nice tool. They are never the final word in this profession

painted with endless shades of gray. I digress.

From there, ES rose on a series of methodical,

unbroken green candles all the way to 1292 without pause. Just a pure absence of

sellers… no real program buying pressure, no wild spikes or bursts. Flagpole

rally, following a day of weakness prior.

ER

(+$100 per index point)

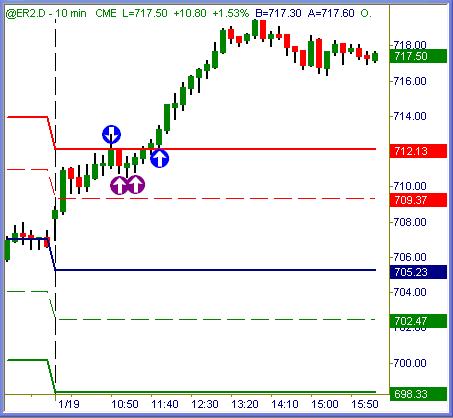

Russell 2000 futures opened on a gap, dropped

-1pt and fired upward from there. While the ES, NQ and YM languished sideways,

ER worked its way upward.

The visible long signal here was a 38% pull

back from session low to high swing… one that was charted by 1,000s of retail

traders in every time frame played. Doesn’t matter what length of chart one

uses: retracement swings like this are all the same.

After that lone pull back, price action rose

straight up like an arrow for more than +8pts gain from the little dip.

Afterward, the tape went sideways in staccato fashion to end this day.

More To The Story

Is that it? Were there any other potential trade entry decisions inside

Thursday’s session?

Why sure… lots of them! There are always

dozens if not hundreds of various entry decisions each day. Successful trading

is much more about filtering out / exiting the wrong ones than it is sticking

with the right decisions.

ES (+$50 per index point)

Countless retail traders rely on floor level

pivots for buy/sell decisions. Retail traders (not floor traders) tend to sell

R-value resistance and buy S-value support when hit. Emini retail traders tend

to be reversal minded, i.e. constantly trying to fade directional moves rather

than go with the trend.

For whatever reasons, most short-term traders

fixate on where price action is likely to stop and turn. That is tough sledding.

Much easier to have price turns or continuations confirmed using high-odds chart

tools while expecting directional moves to continue instead of reverse. In other

words, have the mindset of following directional swings rather than futile

attempts to guess where price action might stop.

Retail traders who use floor levels to trade

with that shorted R1 had to likewise buy the break & close above said resistance

now turned support. That’s precisely how the floor traders and savvy retail

traders use these values as a price-action filter.

The “easy” trades yesterday (if there is ever

such a thing) were to short opening gap down to the pivot, buy the pivot, buy

the R1 break confirmed with other chart tools. Everything else was a struggle.

Of course there are many viable trade entry decisions inside any given day, with

literally 1,000s of methods and systems used to identify them.

Whatever the case may be, expecting each swing

move to trend & extend will reward you with being correct roughly 1/2 the time,

and you will ride the biggest & most profitable trades along the way.

Contrary to incorrect assumption, intraday

price action trends or swings directionally about half the time… over the

course of time. That includes periods of five-day range bound chop followed by

five days of directional or expanded swings of action. Half a session may chop

sideways, offering little scalp profits along the way. The other half of that

same session may post the day’s entire range in one move, where easiest and

biggest profit potential usually exists.

If you are a reversal trader, please don’t

marry a “fade trade”. Be just a quick to reverse the reversal fade, as you will

see…

ER

(+$100 per index point)

… in this example where Russell 2000 futures

blew right through R1 levels early on, then retail traders sold into R2 level (blue

arrow) that dropped exactly -1.5pts from there. That drop happened to halt right

on top of 38% swing of the session’s current range. If a trader is short from R1

just because, they darn sure better measure that retracement (i.e. 1,2,3 swing)

coming right back up in their face as the bulls continue their stampede.

The true reversal trader who played the R2 fade

trying to catch a trend reversal there should have then reversed the short

position when price action:

#1) closed above the R2

#2) pulled back into R2 previous resistance now presumed support

Those who did that sequence correctly caught

profitable chunks. Those who bought the early 38% dip and ignored all false

resistance (our chart tools remained 100% bullish all the way) rode big profits.

Those who missed the move entirely? Big deal… just one session out of some 250

this year.

Trend trading weekly charts is easier than

swing trading daily charts, which is easier than swing trading hourly charts.

Trading hourly charts is easier than trading 10min charts, which is easier than

trading 2min charts. Time compression, speed of decisions necessary and the

limited ratio of profit potential to minimum loss possible to contain make

intraday trading the most skilled approach in our profession.

Having a mindset to follow trends (relative to

the chart) versus always seeking reversals will make success much easier to

attain. Having the emotional ability to sit out from setups that don’t meet your

current level of understanding is another key to overall success. Lastly,

reversal traders must always remain willing to reverse their position quickly

when chart tools confirm that the attempt to buy bottoms or sell tops is

incorrect.

Summation

While anything is possible at any time in financial markets, option expiry

Friday following a directional session previous usually results in sideways mush

& slush. Unless I see something real compelling to trade, my week is complete

already. In any event, please have an excellent weekend!

Trade To Win

Austin P

(Online video clip

tutorials…

open access)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.