Gamblers, Ramblers, and Troublemakers: 5 Stocks Ready to Rock

If you want to see the motivations and true selves of hard core gamblers spend some time in a Las Vegas Casino. It is very interesting to watch the stages the average slot machine player goes through as they continuously lose pulling the arm of the one armed bandit. Happiness and joy eventually turn into desperation as the losing masses start to ramble from machine to machine hoping against hope to find a winner.

During this time, the casino is often offering free drinks and other distractions to keep their minds off of their bank roll losing behavior. However, this alcohol altered state combined with the depression of constant losing can easily turn into bringing out the worse behavior. The once mild mannered gambler turns into a first class troublemaker. I have witnessed hitting of the machine, verbal abuse to fellow patrons and staff, and actual fisticuffs as security eventually escorts the frustrated and drunk player back out to the street. These people have no edge and do not have any understanding of probabilities; otherwise they would not be playing games they are guaranteed to lose.

Unfortunately, many short-term stock traders don’t have an edge when it comes to picking stocks to trade. They keep moving from tip to tip and from news story to news story, like the slot machine players profiled earlier, trying to locate companies that will outperform over the short-term. This gambling like behavior generally results in losses.

We have discovered an easy 3 step method that has been proven time and time again to firmly place the odds of success in your corner when choosing shares for short-term gains. This system allows you to sidestep the masses that use the stock market as a casino and join the traders that use the winning tools of high probability trading. This article will explain the 3 steps and provide 5 stocks meeting each of the criteria for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day simple moving average. This assures that a strong, long-term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short-term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short-term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 5 names that fit the criteria for your watch list:

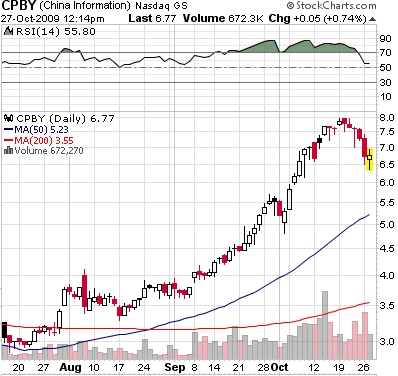

China Security Information

(

CPBY |

Quote |

Chart |

News |

PowerRating)

CyberSource

(

CYBS |

Quote |

Chart |

News |

PowerRating)

Global Crossing

(

GLBC |

Quote |

Chart |

News |

PowerRating)

Stein MartÂ

(

SMRT |

Quote |

Chart |

News |

PowerRating)

Vonage

(

VG |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.