Good News Cycle Profits & 3 PowerRatings Stocks

The economy is back in a good news cycle. Major media outlets are pumping positive, bullish news onto the wires nonstop. Corporate earnings have been upbeat and most economic reports are showing improvement. Examples of the positive news cycle abound daily.

The session’s earnings surprise of Deere & Co reporting much better than expected results and upping its full year guidance only adds to the bullish fever. Plus, new construction starts increasing and escalating production makes it appear that the good times will never end.

When the positive results of individual companies combine with good word from the macro economic picture, bulls can expect good news cycle profits. The problem with relying on the good news cycle for profits is no one knows just how long it will last. As we have seen in the past, the positive media spin can turn viciously negative on a dime. With this in mind, how does it apply to short term stock traders? How can a short term trader take advantage of the good news cycle?

The truth is we can all observe the effects of positive news upon a stock, but once the move takes place, it’s too late to capture profits. Although there are very nimble fast traders with superior data feeds who can profit directly from good news, the vast majority of us have neither the access nor ability to preempt everyone else to capture these explosive moves. Quantifying the tactic of buying weakness instead of news-triggered strength is a powerful method of capturing profits in short term stock trading.

We have broken this technique into a simple 3 step process that focuses on finding companies that are just weak enough to attract professional stock traders and bargain hunters resulting in short term gains. While positive news hitting the wire while you are short term invested into one of these stocks is encouraging, it isn’t a necessary factor for gains. Here is the 3 step quantified and tested system that has been proven effective regardless of how long the good news cycle lasts:

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

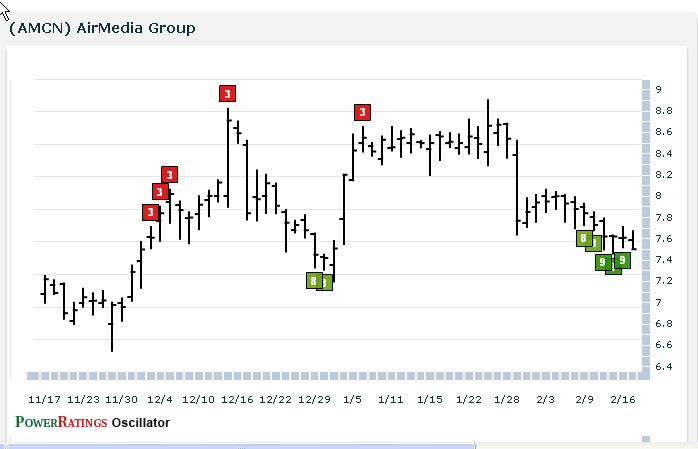

Here are 3 PowerRatings stocks for your consideration:

^AMCN^

^MAPP^

^ZIGO^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.