Goodboy: Piping and Rolling in the FX

Piping and rolling in the FX? Sounds like the latest Hip Hop video on MTV, and not crucial topics to understand while Forex trading. Pips and rolls are elementary, but often misunderstood terms in the Forex marketplace.

This article will define the terms, give an example or two, and make it easy for you to remember. Please note, we are focused on retail Forex, interbank institutional Forex is not the same animal, however there are some similarities.

Let’s start out with the easy one, PIP. My first experience in the FX market was with a demo platform from a large retail dealer. The platform was set up to make a piping sound at every PIP change in whatever pair you were watching. Of course, I mistakenly believed that is how a PIP got its name. In actuality, a PIP is an acronym for Percentage In Point, and not a sound as I first believed.

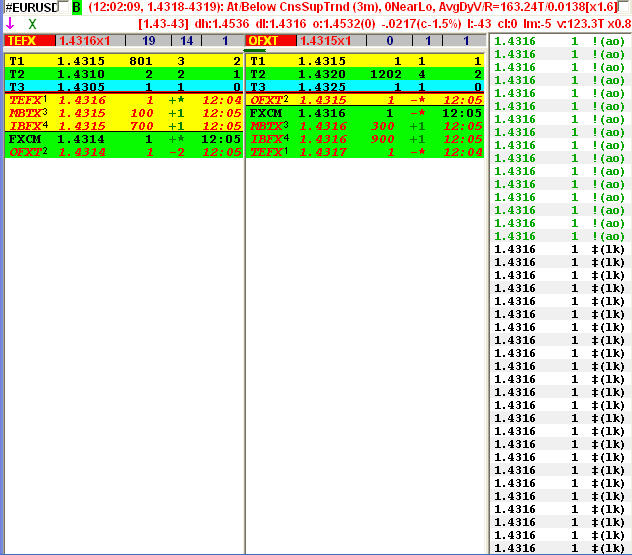

A pip is equivalent to a tic in the futures market. It is the smallest increment a FX pair can move. Pairs are normally priced four decimal points out, meaning that the last 0 is the smallest move or PIP. It is 1/100 of a basis point or percent. In a regular retail Forex account, lots are sized at $100,000.00 each, therefore a PIP is equal to $10.00. Some dealers offer mini size lots of $10,000.00 each, making each PIP worth $1.00. Still others, like OANDA, for instance offer micro size lots curbing PIP size down to the penny. Here is an example of a Depth of Market Screen showing pricing of the EUR/USD across 5 major dealers, so that you can see the 4 decimal point PIP moves:

Now that we have PIPs out of the way, let’s move on to a slightly more complicated subject, the ROLL, ROLLOVER, AKA the “INTEREST RATE DIFFERENTIAL”. I am going to keep the explanation as simple as possible in this article. At the most basic, since the countries that issue the different currencies have different interest rates, each pair can either pay interest (positive carry) or require the trader to pay interest (negative carry) depending if the trade is long or short at the time.

Retail dealers have differing rules and requirements regarding Rollover. It is critical that you know your dealers policy so that you can choose the dealer with the most advantageous situation depending on what pair you are trading. Some traders have found the rollover to be so advantageous that entire hedge funds have been built around this inherent fact. The strategy is called the carry trade and until recently literally billions were earned utilizing the Yen pairs. I have traded with dealers that do not pay for positive rolls, only charging you for negative rolls, plus all kinds of other games. I can not emphasize enough the importance of you fully understanding your dealer’s policies in this regard.

Good Luck!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.