Greed Trumps Fear & 3 PowerRatings Stocks

The one constant that has been proven again and again is that greed will always trump fear in the stock market. This fact is what powers the market’s upward drift since its inception back in 1792.

Nowhere is this clearer than in the world of big money investors. There are numerous examples of disgraced, blown out hedge fund managers starting new funds with more money than ever. Clearly the greed of these new investors blinded them from the past losses of the same manager.

John Meriwether from Long Term Capital Management is once such blown up fund manager who used this quirk of human nature to re-launch another monster fund despite his well publicized massive loss. And this same phenomena can be seen among all strata of professional investors.

The professionals generally only buy stocks at a discount, after they have been beat down. The pros are taking advantage of the greed trumping fear maxim. In fact, I would go as far as to say it is the only constantly proven, long term, exploitable edge in the stock market.

The best part is, it’s an easy edge to master once you understand the psychology behind it. The greed of getting a bargain is the same drive that pushes consumers to store sales as it guides professional investors to seek cheaply priced stocks. This can be seen in the stock market as every sharp sell off is bought while the market drifts ever higher despite some longer term pull backs and lulls. The greed for gain beats the fear of loss again and again.

We quantified and studied this fact via extensive testing over 1000’s of stock market trades. A simple, easy to use 3 step system emerged to assist you with choosing stocks most likely to outperform in the short term. The remainder of this piece will lay out the 3 steps and provide 3 PowerRatings stocks for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame

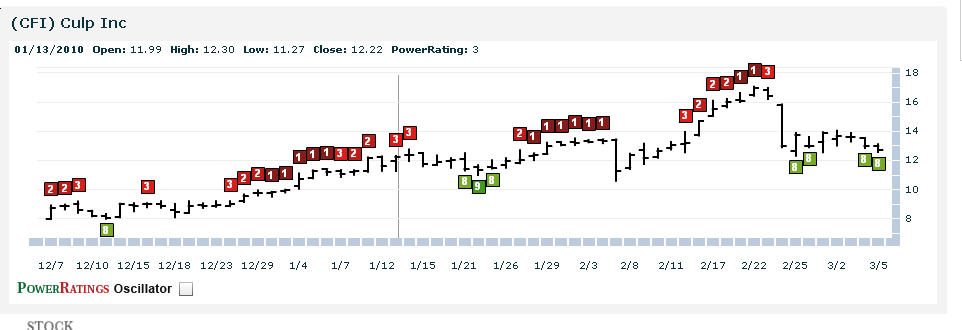

^CFI^

^NR^

^VISN^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.