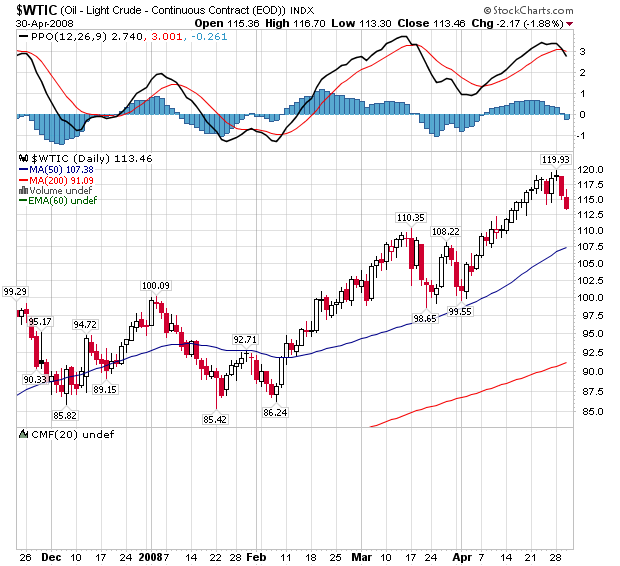

Has Oil Peaked?

Oil, Black Gold, Texas Tea, whatever you call the precious black commodity, has been on a ripping uptrend since January, 2007. Due to the personal connection with gasoline, many people seem to treat oil differently than any other commodity; subscribing an almost mystical or supernatural aura to the uptrend. Fear of super high prices at the pump and other economic disaster scenarios add to this irrational belief that the uptrend will never end. In reality, oil is the same as any other commodity, it moves in waves, cycles predictable or not, depending on your perspective. Oil will drop again; it’s just a matter of when.

In my opinion, oil has peaked, at least for the short term. There are both sound fundamental and technical reasons to back up this opinion. Let’s start out with the fundamental reasons:

Fundamentally, supply and demand are the drivers of commodity prices. Oil inventories are only down 0.6% off their 5 year average; this makes it clear that there is NO shortage. In addition, supplies have actually climbed 13 out of the last 16 weeks. The dollar and oil are closely tied. A weak dollar seems to make commodities, such as oil, more appealing to international investors hence putting upside pressure on oil futures. Yesterday, the Fed signaled an easing of interest rate cuts which in turn has begun to strengthen the dollar. A strong dollar generally portends to lower oil, and other commodity prices.

Technically, the daily oil chart is exhibiting classic topping behavior. The all time top tick of 119.93, created 3 days ago formed a DOJI looking candle on the daily chart. A DOJI often precedes a sell off, and the last 2 days appear to reflect the starting of one. The 50 day SMA is at 107.38, the 200 day SMA is 91.09.

It is my opinion that oil will be <= 101 prior to reaching 125. Looks like an excellent short opportunity right now.

Good luck!

Dave Goodboy is Vice President of Marketing for a New York City based multi-strategy fund.