Hedging Your Portfolio

Jim Graham is OptionVue’s Product Manager and develops and enhances the company’s OptionVue 5 Options Analysis Software to meet the real-world needs of institutional and individual options traders.

Institutions and mutual funds are the biggest customers for index options. To manage large diversified stock portfolios, it is easier to purchase puts on an index or sector rather than doing hundreds of trades on each individual stock. When analyzing how to hedge their risk, they must balance the cost of the strategy against their opinion of the market.

The objective of the index option purchase is to limit or insure against portfolio losses. But index puts are not cheap. So why are managers willing to risk underperforming the market by 3% or so during a 90-day period (approximately a 13.2% annual rate)?

Some try to keep a little protection on no matter what the current market conditions are like. But it is only natural that they are more willing to take that risk if they have a bearish view. They hope to beat the market by profiting from the index puts.

The technique of hedging a portfolio is straightforward. The first step is to find the index with the composition that most closely resembles your own portfolio. You then purchase out-of-the-money protective puts.

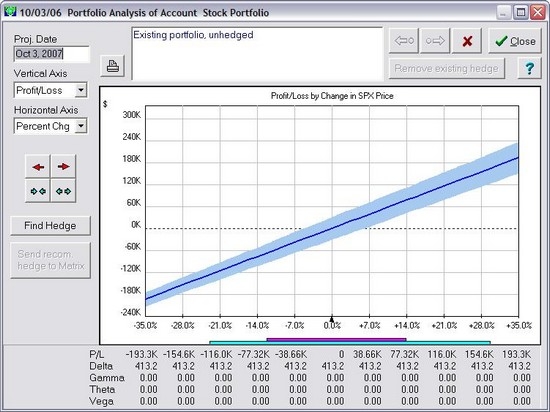

But portfolio hedging can be as much art as science. With stocks you need to purchase one put for every 100 shares of stock. But your portfolio is unlikely to have precisely the same stocks in the same proportion as the index you use to hedge. There is a feature in OptionVue 5 called HedgeFinder that allows you to graph the risk of your portfolio relative to an Index. Below is an example of how a $500,000 portfolio with holdings in 19 different stocks should perform relative to the S&P 500 index.

The vertical axis shows your profit/loss while the vertical axis is % change in the S&P 500 index. Measures such as portfolio delta that allow you to come close to knowing how a portfolio will react, but notice the light blue shading around the solid line. That indicates the possible tracking error, since your portfolio is not an exact duplicate of the S&P 500. That is what allows hedging a portfolio to remain a bit of an art.

Since there is always going to be some tracking error, don’t spend too much time worrying if you have the precise amount of puts covering your portfolio. You just want a hedge that performs its primary purpose: to protect against large and broad declines in the market. If the market is dropping, any hedge at all will offset at least part of your losses.

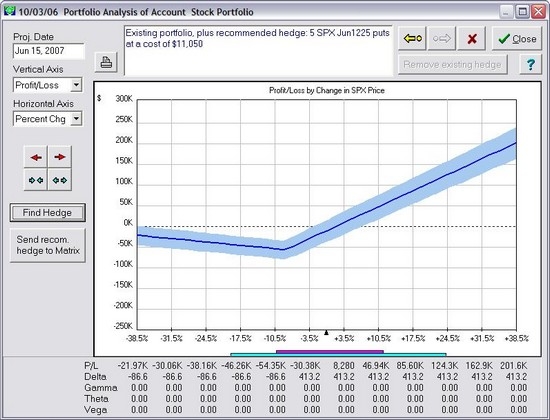

The Tool in OptionVue 5 allows you to set certain parameters and have it look for the best hedge. After telling the program that I would not accept more than a 10% drop in my portfolio value over the next six months, it recommended the following hedge.

Buy 5 of the June 1225 puts in the S&P cash-settled index options at the CBOE at a cost of $11,050. That represents a cost of 2.16% of my portfolio to hedge my risk until June.

The unusual part of this strategy is your true goal: purchase the puts in the hope they expire worthless! Strange as it may sound, a portfolio manager actually hopes that his out-of-the-money put options expire worthless. An honest homeowner does not hope that his house burns down so that the insurance policy will pay off. In the same way, a portfolio manager that buys out-of-the-money puts does not want the market to decline. He would rather get the higher profits that come from his stocks going up in value.

This is a hard concept for many investors to understand. But an experienced money manager recognizes there are times when a sharp market correction, while not expected, has a high enough probability of occurring to justify the expenditure of 1% to 3% of the portfolio on out-of-the-money puts for a few months of insurance.

Stocks do tend to move generally in the same direction as the overall market. Just as a strong bull market tends to pull most stocks in an upward direction, even those stocks whose individual fundamentals are strong tend to decline when the overall market does. Index options allow you to manage your risk and preserve capital in market downturns.

You can find more how-to and educational articles to improve your investing and trading each day on TradingMarkets.com.