Here are 3 short-term trade setups

We have three pairs today that offer solid set-ups over the next 24-48 hours,

those being USD/JPY, USD/CHF and NZD/USD – a couple of footnotes:

– entries for 24-Hour Target Trades are typically made at the time of posting

(i.e. 5:05 AM PDT for today)

– given that there has been a big move overnight, prices still may pullback a

bit more before resuming their path towards our projected target prices. Hence,

traders may wish to scale into these trades at current levels and at the levels

noted below

USD/JPY – 112.30

USD/CHF – 1.2155

NZD/USD – .6375

Looking at the Dollar Index (DXC) from a longer-term perspective, the long

holiday weekend ushered in more selling in the dollar (DXC). In fact, the

sell-off that began on Monday has now resulted in an outright sell signal based

on our weekly model. While our weekly model has been quite effective with

signals over the last year, it is key to remember that these signals project out

price direction that may last several weeks/months.

On a short-term basis, DXC is finding support on the 60-min chart at 84.27 and

appears poised to rally towards 84.45-50 before resuming the downtrend.

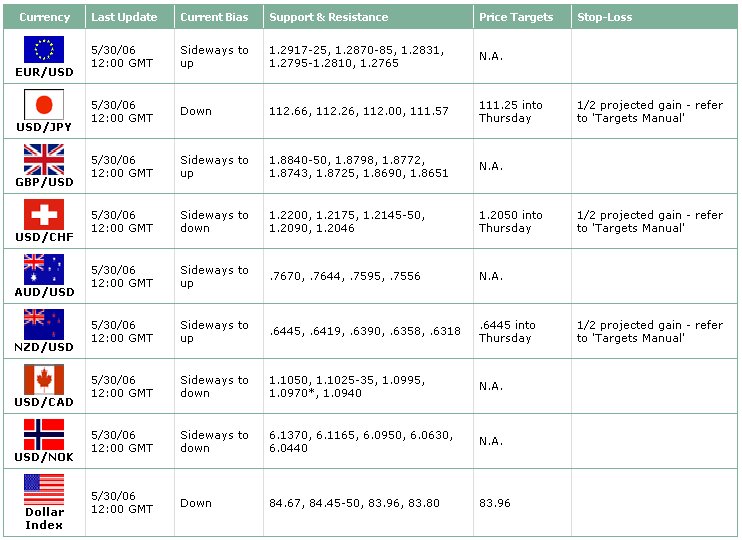

Tuesday’s FX Targets & Technical Levels

Get a live sampling of our intra-day analysis and trade

alerts via our

FX

Desktop Ticker

As always, feel free to send me your comments and questions.Â