Here are the forex trade set-ups I’m monitoring

Dave Landry is principal of Sentive Trading, a money management firm, and a

principal of Harvest Capital Management. Mr. Landry is the author of two top

selling books,

>Dave Landry’s 10 Best Swing Trader Patterns And Strategies and

>Dave Landry On Swing Trading.

If you would like a free trial to Dave’s Nightly Swing Trading Alerts Report

The past week has seen some tremendous moves in the FX markets — not all of

which were easy to capture. The sustained move lower in the dollar never allowed

for those that missed the initial push (us) to establish a trade at reasonable

levels. Given that we never ‘chase’ entry points, we missed out. This, of

course, is unfortunate, but that strategy over a long period of time is

ineffective.

Luckily, we were able to capitalize and turn a nice profit this week but likely

lagged against more aggressive traders/managers. The 24-Hour Target Trades were

the laggards, but the short in EUR/JPY more than made up for this.

Looking ahead, we are waiting for a bounce in the dollar — the timing of which

is like chasing jell-o around a plate. When this does occur, we will be able to

find trades with a solid risk/reward profile.

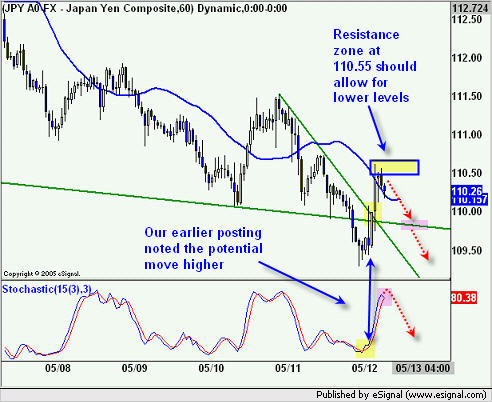

We expect to be making trades in CHF/JPY as well as NZD/USD and the NZD crosses

as we head into next week. For now, the immediate set-up is in USD/JPY — the

charts below lay out my rationale.

Launch the Aspen Trading Group

FX Desktop Ticker

for up to the minute trade alerts and FX commentary.

As always, feel free to send me your comments and questions.

Aspen Trading Group