Here’s The Primary Emotional Catalyst For Trading Today

Premarket

futures are reacting to Hurricane Katrina as you well know long

before these words greet you. The petroleum-based futures have launched to new

recent = all time highs ahead of the storm, which likewise affects stock index

markets around the world. Add in the usual insurance company stock plays,

constructions equipment stock plays, etc and it could be a rather active session

in this session indeed.

S&P 500 dropped nearly -10pts inside the first

two hours, bounced seven of them upwards and immediately got slammed by further

selling back down to session lows from whence it came. Gyrational, program

driven session where nothing in between those three rapid price surges occurred.

ES (+$50 per index point)

Monday’s initial resistance near 1208 and

especially 1210+ are easy to see here this morning. Price action trading above

the 1211 mark will have buy stops kicking out from open shorts and new longs

alike.

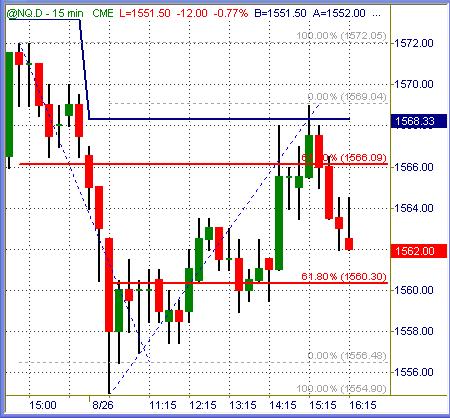

NQ (+$20 per index point)

Nasdaq 100 spanned -18pts down and +14pts up

again. Paltry total dollar ranges, but it did have the most V-shaped tape of all

indexes.

Bullish above 1567 and below 1560 is the general

bias for the start of this holiday week.

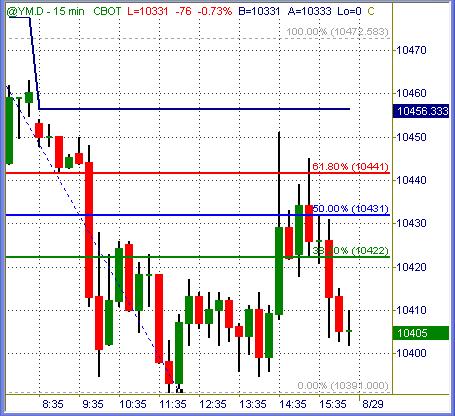

YM (+$5 per index point)

Dow Industrial futures slammed downward, buzzed

sideways, popped higher and immediately sold off into the close. 10420 and then

10440 are the obvious clusters of stop orders staged for today’s early action.

ER (+$100 per index point)

Russell 2000 futures plunged -$1,200 per emini

contract inside the first 90 minutes of trading, and relatively little else for

the next six loooooong hours to end that session and week.

652 level is next visible resistance, with a

break & close above 655.50 being the bullish base for today.

(Price levels posted in charts above are compiled

from a number of different measurements. Over the course of time we will see

these varying levels magnetize = repel price action consistently)

Summation

The hurricane event dominates all news channels and will be the

primary emotional catalyst for trading today. We’ll play the same method signals

as always, and it is possible to see more volume in the market as peripheral

players step in to trade around the news event. I’m playing 1/2 size (or

smaller) normal contract positions until past Labor Day weekend as summer season

draws to an eventful end.

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a

full-time professional trader who specializes in E-mini stock index futures,

equity options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.