Here’s what to expect today

Thursday’s session was

the last session of trading for Feb index option contracts. Much of

what we saw was probably related to keeping a max number of put option contracts

at or above intrinsic value. There was a classic dip and pop move pattern in the

afternoon from highly predictable points that tends to repeat itself during

expiration weeks. a similar performance may be on tap for today, when the

balance of equity option contracts for February expire.

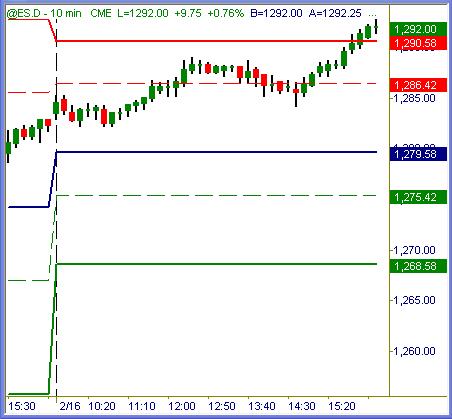

S&P 500 futures traded a 10 point total range,

gently sideways for the most part until the final hour lift from classic support

(not shown) thru R1 trigger (dashed red line) up to R2 values (solid red) good

for at least +4pts if not a bit more. Other trades intraday offered +2pt and

+3pt potential, but the swings were quite muted until the final hour arrived.

ES (+$50 per index point)

ER

(+$100 per index point)

Russell 2000 futures began the morning with

gyrational sideways action, then settled into a flat coil midday on nil volume.

The afternoon perked up with a drop to expected afternoon support before the

end-day flex upward from R1 to R2 values. Rather gentle, sideways session

overall until the final hour as well.

ES (+$50 per index point)

Daily chart view of 2006 shows the S&P for what

it is: sideways. This pattern reminds me of skunk tracks in the snow, if you’ve

ever had the pleasure of following one of those. Eventually the little critter

gets where it intends to go, but the path from start to finish measures ten

times longer than a straight line if stretched out flat.

From essentially 1250 to 1300 for the past six+

weeks, the S&P now pushes another upward leg towards the top end of this range

again. After chopping around the 50dma (olive) for eight consecutive candles, it

has released upside toward previous resistance marks.

ER

(+$100 per index point)

Small caps are a clearer picture: sustained

uptrend with two measured pull backs along the way. Recent dip towards the 50dma

sprung upwards and appears ready to test recent highs / post new all-time highs

once again. ER has led this 3+ year stock market rally all the way, and will

remain the leader until the next bear market correction occurs.

Summation

Normal intraday ranges favor day traders… plenty of swings offering net profit

overall. Absolutely no complaints about recent action at all. The return to

normalcy in the markets that we all knew would occur most certainly has arrived.

Today is equity option expiry. Unless it results

in a pure trend day above & beyond options’ influence, expect some morning

wiggles and flat midday stretch with final hour swings possible into the close.

Monday is a market holiday, so traders will be squaring positions until Tuesday.

On a recent historical basis, the Tuesday following President’s Day has been

down and down big. If they start to sell ’em off to begin the session next week,

history may repeat itself again.

Have a great weekend!

Trade To Win

Austin P

(Full weekend report: online

Sunday 8:00pm EST)