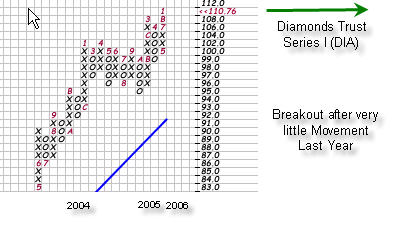

Here’s why I’m buying the DIA

I mentioned in

my column on February 14th that the Dow Jones Industrial Average (DJIA) had

held up better than any of the other major indexes so far in February. Well,

here we are at the end of February and the Dow is the only major index that has

a return over 1% for the month. In fact, the NASDAQ still has a slightly

negative return. The Dow is breaking out to new highs while the others have

rallied back to resistance (or not even done that in the case of NASDAQ).

Also of importance is the fact that the New York

Composite Index has broken out to new highs as well. Focusing on the Dow, what

is causing this breakout? If you are not aware, the Dow Jones Industrial Average

is price weighted, meaning the higher priced the stock, the greater its’

influence on the movement on the Dow. Let’s take a look at the five stocks in

the Dow 30 that have the most weight in the Average as of today. They are as

follows and in the following order:

1.

(

IBM |

Quote |

Chart |

News |

PowerRating)

2.

(

BA |

Quote |

Chart |

News |

PowerRating)

3.

(

MMM |

Quote |

Chart |

News |

PowerRating)

4.

(

CAT |

Quote |

Chart |

News |

PowerRating)

5.

(

AIG |

Quote |

Chart |

News |

PowerRating)

Without even looking at the charts, I would have

to say that BA is causing this divergence. IBM is in a negative trend and has

not had a good February (down 1.23%). BA has had a fantastic February, up 9.24%.

MMM is in a negative trend, similar to IBM, but it has had a price increase of

2.2% so far this month. Next is Caterpillar, Inc. This Dow Component is in a

positive trend and has had a return of about 5.4% in February. AIG is showing

some improvement on a technical basis and has a return of 2.3% for February.

Actually, it is not just BA; four of the top five components seem to doing

pretty good. This to me is screaming that the out performance in the Dow is not

just an anomaly.

I think that

(

DIA |

Quote |

Chart |

News |

PowerRating) (Diamonds Trust Series I)

is a good trade here. I would not jump in with two feet, however. The long term

(using a change in %) calculation of Relative Strength still shows the ETF

lagging both

(

SPY |

Quote |

Chart |

News |

PowerRating) (S&P Depository Receipts) and

(

QQQQ |

Quote |

Chart |

News |

PowerRating) (NASDAQ 100

Trust). The Qs are starting to under perform however in the shorter- term (using

a change in price only) calculation of Relative Strength. Buy some DIA now and

some more later as conditions evolve.

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.