Here’s why I’m expecting good directional action today

Those dead-flat coils from Friday noon

thru Monday’s close did indeed break as predicted, but not in the manner

expected. Yesterday’s emini session was filled with exaggerated, sideways

action. The afternoon rally attempt was sold into with gusto, pressing indexes

back toward lows for the session to end the day. That in itself sets us up for

what could be directional action today.

ES (+$50 per index point)

S&P 500 has layered resistance from 1241 to

1243, which is likely to hold any upside attempts today. A break below recent

swing near 1235+ would send this symbol probing for support considerably lower

than that. 1245 is the line of demarcation for bulls, if they intend to keep the

party going in northward direction.

MD (+$100 per index point)

S&P 400 has a short-term ceiling near 723 with

plenty of sell stops parked there right now. 718 level must hold, or she’s

headed back down to test Katrina lows again. Break and confirm above 725 has new

highs in sight from there.

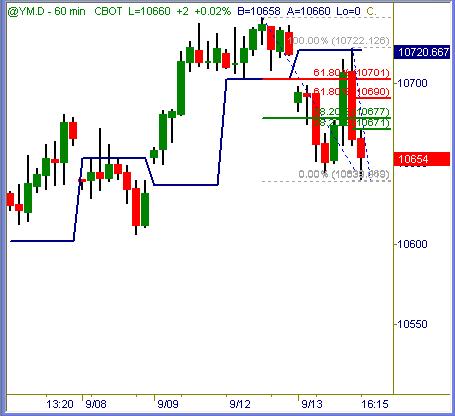

YM (+$5 per index point)

Dow Industrial futures stare at 10670 and then

10700 as high hurdles to leap today. More probable to stall out and continue

lower, but upside break & close above 10700 has buyers back in charge.

ER (+$100 per index point)

Russell 2000 futures are a strong sell near 680

and don’t turn bullish confirmed until above 683. 673 must hold for further

upside potential to exist before deeper corrections ensue.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

The emphatic afternoon drop after irrational pop yesterday taught dip

buyers that every apparent bottom will not hold. I would expect the same

dipsters who got burned yesterday to either lay off the long side aggressively

or hit the sell side in momentum fashion should selling begin to take hold. It

has been many sessions since the last large-range directional day… odds of

probability and recent intraday instability suggest a big day may be coming

soon.

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.