High PowerRating, Low Price: 3 Stocks for Traders

Stocks are in the red in the first few hours of trading on Thursday as sellers continue to push prices lower in the wake of mildly overbought conditions from earlier in the week.

With the S&P 500 and Dow industrials both diving into oversold territory early on Thursday, the odds for a bounce are growing. As I have said before, it is true that oversold can and does become all the more oversold – especially when the market in question is trading below the 200-day moving average.

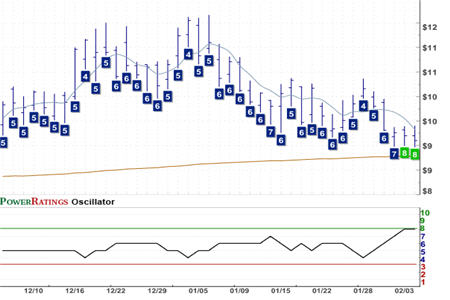

USA Mobility Inc.

(

USMO |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 5.02

And while this means we would be reluctant to buy the whole market – the S&P 500, for example, or the Dow industrials – it also means that those stocks that are still trading above their 200-day moving averages and have pulled back in recent days are increasingly attractive candidates for trades to the long side.

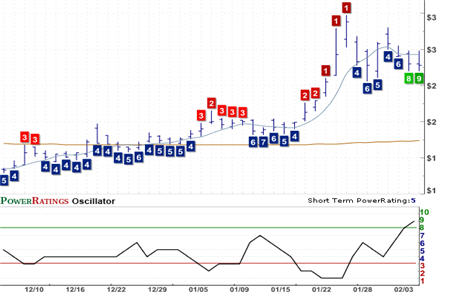

Stem Cells Inc.

(

STEM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 16.10

When stocks are falling, it can be a psychologically difficult thing to step in and buy. But our research into short term stock price behavior is clear: there is a significant edge in the short term for traders who buy extremely oversold stocks and ETFs trading above the 200-day moving average. The key is in identifying oversold stocks accurately – which we do with tools like our Short Term PowerRatings, the 2-period RSI and the 200-day moving average – and then looking to buy below (or sell short above when looking to bet against stocks) the high Short Term PowerRating stock’s last closing price.

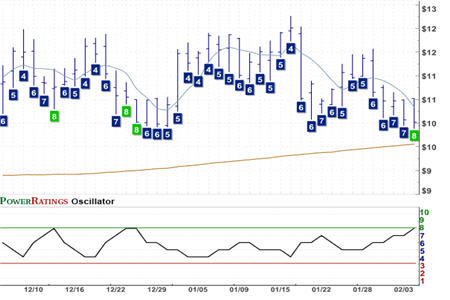

Wausau Paper Company

(

WPP |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 7.06

Note that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days. Stocks with Short Term PowerRatings of 9 have performed even better, beating the average stock by a more than 13 to 1 margin after the same, short term time frame.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.