High PowerRating, Low Price: 3 Stocks for Traders

Stocks are hovering around breakeven levels an hour into the trading day on Thursday, with the S&P 500 stronger and the Nasdaq weaker.

It’s been a little while since we’ve highlighted stocks that didn’t just have high Short Term PowerRatings, but also had low prices in dollar terms. While the number of stocks with low dollar prices, under $15 for example, has certainly grown since the bear market began, the combination of low prices and high Short Term PowerRatings can be part of a winning trading strategy for short term traders.

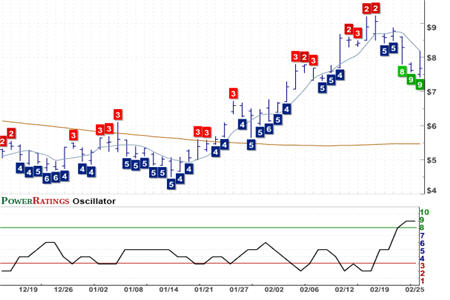

Siga Technologies Inc.

(

SIGA |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 13.69

As a high probability trading strategy, trading with our Short Term PowerRatings means that many times, traders will be able to profit from short, occasionally small moves as stock rally from oversold conditions or correct from overbought conditions. Because these point moves can be small, traders who are able to trade relatively large size positions can often take best advantage of these sorts of opportunities.

DRD Gold Ltd.

(

DROOY |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 8.16

This is where high Short Term PowerRatings stocks with low prices come in. With their lower prices in dollar terms, these high Short Term PowerRatings stocks with prices of $15, $10 or less, can be a good fit for short term traders who would like to be able to take more profit out of a likely market move without having to rely on the market move being longer or more sustained than the trading strategy calls for.

Increasing your size as you become more comfortable and more adept with your trading is a strategy that traders have followed for years. For traders who have modest account sizes, high Short Term PowerRatings stocks with low dollar values can help make this approach to trading possible.

Anadys Pharmaceuticals

(

ANDS |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 9.05

Recall that our research into short term stock price behavior indicates that stocks with Short Term PowerRatings of 9 have outperformed the average stock by a margin of more than 13 to 1 after five days.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.