High Probability ETF Trading Report – Overbought Housing ETFs: XHB, ITB, URE

Thursday’s rally has left few if any exchange-traded funds (ETFs) in our database that are oversold. This means that high probability ETF traders should be poised on the sidelines waiting for the next pullback before stepping back in to the market on the buy side.

On the sell side or, rather, the sell-short side, we do have a number of ETFs that have entered — or remained in – overbought territory in recent days. For ETF traders who want to play both sides of the market — selling short overbought ETFs as well as buying oversold ETFs — then these ETFs may represent potential opportunity over the next few days.

Curious about strategies for trading ETFs? Read our primer, How to Find and Trade Overbought and Oversold ETFs.

All of the ETFs in today’s report are related to the housing and real estate markets. The stocks in these markets have been advancing in recent days out of a sense that the economy is improving. At least, that’s the official story. Here in the world of high probability, mean reversion trading, however, all we know is that markets that enter extreme overbought territory below the 200-day moving average often represent opportunities for high probability short sales.

Shares of SPDR Homebuilders ETF

(

XHB |

Quote |

Chart |

News |

PowerRating) surged higher on Thursday, gaining more than 5%. XHB includes major home builders such as KB Home

(

KBH |

Quote |

Chart |

News |

PowerRating) — which reports quarterly earnings on Friday — and DR Horton Inc.

(

DHI |

Quote |

Chart |

News |

PowerRating).

As of Thursday’s close XHB had a 2-period RSI of more than 90.

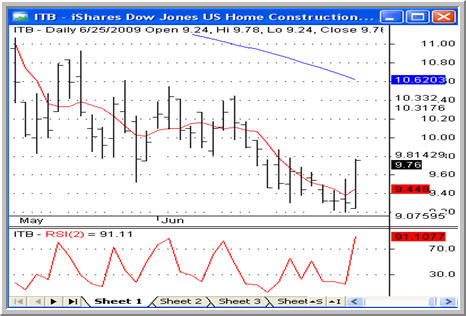

Providing exposure to many of the same home builder stocks as XHB, the iShares Dow Jones U.S. Home Construction Index ETF

(

ITB |

Quote |

Chart |

News |

PowerRating) is another option for short term traders looking to take advantage of overbought markets trading below their 200-day moving averages.

Also earning a 2-period RSI in excess of 90, ITB is an exceptionally overbought ETF that could provide opportunities in the event of further strength below the 200-day moving average.

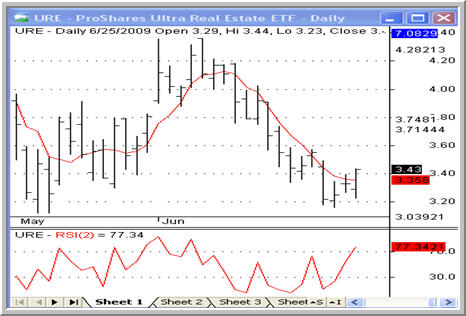

Traders looking for a different kind of leveraged play on real estate may want to consider an ETF like the ProShares Ultra Real Estate ETF

(

URE |

Quote |

Chart |

News |

PowerRating). URE is leveraged 200% to the daily return of the Dow Jones U.S. Real Estate Index. Unlike ITB and XHB, which provide exposure to home building stocks, URE tracks real estate investment trusts (REITs) such as Simon Property Group

(

SPG |

Quote |

Chart |

News |

PowerRating) and Boston Properties

(

BXP |

Quote |

Chart |

News |

PowerRating)

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to order High Probability ETF Trading, the first quantified book of trading strategies to improve your ETF trading.>>

David Penn is Editor in Chief at TradingMarkets.com.