High Probability ETF Trading Report: Oversold Asia, Commodity Pullbacks

The number of oversold ETFs surged over the past few days, even as the major markets have continued higher.

Most of these ETFs entering pullback mode fall into one of two categories: Asian country ETFs and commodity ETFs. As high probability ETF traders, both types of ETFs are of interest as potential trades. But it is the country ETFs that may perhaps provide a greater opportunity for traders looking to maximize the power of high probability ETF trading.

As Larry Connors has observed, country ETFs tend to move back and forth between overbought and oversold conditions more consistently and reliably than other types of ETF. This includes equity index ETFs, sector ETFs and commodity ETFs. As such, when we come across any list of oversold ETFs, it is the country ETFs to which our attention is drawn first.

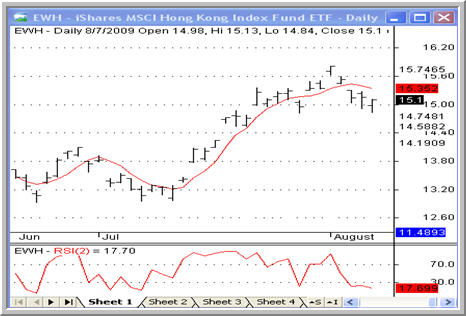

There are a couple of oversold country ETFs as of the Friday close that high probability ETF traders may want to keep an eye out for. They include the iShares MSCI Hong Kong Index ETF

(

EWH |

Quote |

Chart |

News |

PowerRating).

And the iShares MSCI Singapore Index ETF

(

EWS |

Quote |

Chart |

News |

PowerRating).

Continued weakness in either of these ETFs will likely attract buyers interesting in picking up shares of these ETFs as they pullback.

While we don’t put commodity ETFs at the top of our high probability ETF trading list — for the reasons mentioned above — these ETFs can represent opportunity for traders when they reach truly extreme levels of being either overbought or oversold. Another option for high probability traders is to look more toward those commodity ETFs that are equity-oriented as opposed to pure commodity plays. For example, the Market Vectors Gold Miners ETF

(

GDX |

Quote |

Chart |

News |

PowerRating) (shown below) is based on the share prices of gold and silver mining stocks, while the SPDR Gold Shares ETF

(

GLD |

Quote |

Chart |

News |

PowerRating) tracks the spot price of gold bullion.

Larry Connors will be conducting a 2 1/2 day High Probability ETF Trading Seminar beginning August 14. If you’d like to attend a free online presentation explaining the concepts of High Probability ETF Trading and introducing the 2 1/2 day Seminar coming in early August, please call 1-888-484-8220 ext. 1 or click here to register today.

David Penn is Editor in Chief at TradingMarkets.com.

Want updates on our latest articles? Have something to say to David Penn or

the staff at TradingMarkets? Follow David on Twitter at @Penn_TM and TradingMarkets at @Trading_Markets. You can also join the

discussion on Facebook by logging onto our fanpage

.