High Probability ETF Trading Report: Pullbacks in Bond ETFs

What do you think is the most overbought exchange-traded fund (ETF) right now?

How about the SPDR Homebuilders ETF

(

XHB |

Quote |

Chart |

News |

PowerRating)? XHB tracks the share prices of home builder stocks like KB Home

(

KBH |

Quote |

Chart |

News |

PowerRating), as well as companies that make products for the home like Bed Bath and Beyond

(

BBBY |

Quote |

Chart |

News |

PowerRating). And trading above its 200-day moving average, XHB — which has a 2-period RSI of more than 99 – is the most overbought ETF in our database.

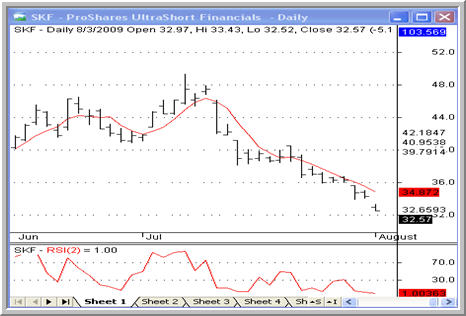

Most oversold? Take a look at the ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating). SKF is built to mimic two times the inverse of the daily performance of the Dow Jones U.S. Financials Index. And as you can see in the chart below, what has been bullish for financial stocks over the past several days and weeks has been quite bearish for the SKF. (Although not shown, the SKF is trading very much below its 200-day.)

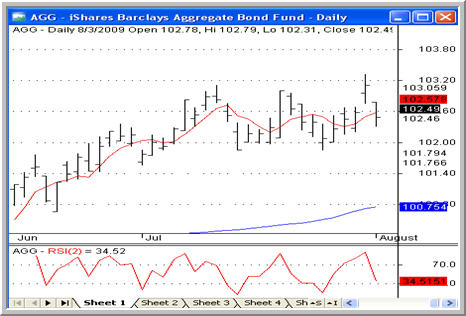

Analysis like this helps high probability ETF traders get a sense of which way the winds are blowing. But when it comes to specific trading opportunities, we know that we need to pay attention not just to overbought ETFs but overbought ETFs below the 200-day. Similarly, we need to focus on more than just merely oversold ETFs, but instead look for oversold ETFs that are trading above their 200-day moving average.

To this end, those ETFs that are pulling back above their 200-day moving average and may represent potential opportunity for high probability traders are bond ETFs. Most of these ETFs have not yet entered oversold territory above the 200-day, but given the way that bonds are trading opposite stocks of late, further upside progress in stocks could help create meaningful pullbacks on bond ETFs like the iShares Barclays Aggregate Bond ETF

(

AGG |

Quote |

Chart |

News |

PowerRating)

Other bond ETFs that fall into this category include the iShares iBoxx Investment Grade Corporate Bond ETF

(

LQD |

Quote |

Chart |

News |

PowerRating) and the iShares Barclays TIPS ETF

(

TIP |

Quote |

Chart |

News |

PowerRating). Again, none of these ETFs are in oversold territory above the 200-day yet. But high probability ETF traders should be on the alert should additional selling bring these bond ETFs down to more attractive levels.

Larry Connors will be conducting a 2 1/2 day High Probability ETF Trading Seminar beginning August 14. If you’d like to attend a free online presentation explaining the concepts of High Probability ETF Trading and introducing the 2 1/2 day Seminar coming in early August, please call 1-888-484-8220 ext. 1 or click here to register today.

David Penn is Editor in Chief at TradingMarkets.com.

Want updates on our latest articles? Have something to say to David Penn or

the staff at TradingMarkets? Follow David on Twitter at @Penn_TM and TradingMarkets at @Trading_Markets. You can also join the

discussion on Facebook by logging onto our fanpage

.