High Probability ETF Trading Report: Pullbacks in Country ETFs

With the equity index futures moving higher in the hour before trading opens on Thursday, some of the pullbacks that have been developing in a number of ETF markets may not last for very long before buyers swoop in and pick up shares of these oversold ETFs.

But unless and until that moment arrives, high probability ETF traders may want to pay extra attention to the pullbacks in Asian country ETFs. From Taiwan to mainland China to Singapore and Hong Kong, a number of these ETFs have entered oversold territory above the 200-day moving average and may represent an opportunity for traders looking to buy these ETFs as the market puts them on sale.

The iShares MSCI Taiwan Index ETF

(

EWT |

Quote |

Chart |

News |

PowerRating) was the first country ETF to begin pulling back, slipping into oversold territory above the 200-day on Tuesday.

Wednesday’s close has brought EWT even deeper into oversold territory, making EWT among the more attractive potential candidates for high probability ETF traders.

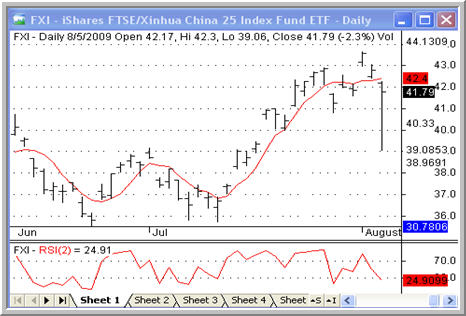

iShares FTSE/Xinhua China 25 ETF

(

FXI |

Quote |

Chart |

News |

PowerRating) dropped into oversold territory as of Wednesday’s close-but only barely. Additionally, the fact that the ETF closed significantly off very deep intraday lows is a short term bullish sign-and one that suggests that there may not be much “pullback” left.

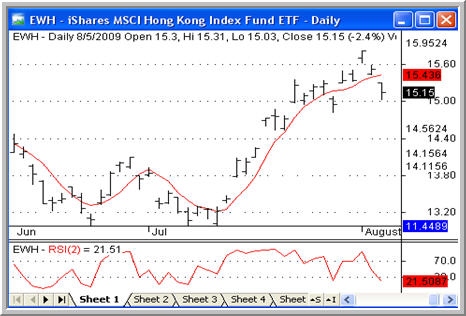

Also moving into oversold levels for the first time on Wednesday was the iShares MSCI Hong Kong Index ETF

(

EWH |

Quote |

Chart |

News |

PowerRating).

EWH’s pullback appears more enduring than FXI’s-with its intraday rally. But it remains to be seen if the ETF will show the kind of additional weakness that will bring the ETF deeper into oversold territory-a prerequisite for a true high probability opportunity for short term traders.

As an aside, I’ve noticed a growing amount of negative or pessimistic news and analysis on China over the past few days. Andy Xie, former star China analyst for Morgan Stanley

(

MS |

Quote |

Chart |

News |

PowerRating), for example, recently wrote a blistering analysis of the Chinese economy, calling current efforts there “a Ponzi scheme.”

Whether or not critics like Xie are correct, what they are saying does feed into the current impulse to sell Chinese and Chinese-sensitive (i.e. Taiwan, Hong Kong) equities.

Larry Connors will be conducting a 2 1/2 day High Probability ETF Trading Seminar beginning August 14. If you’d like to attend a free online presentation explaining the concepts of High Probability ETF Trading and introducing the 2 1/2 day Seminar coming in early August, please call 1-888-484-8220 ext. 1 or click here to register today.

David Penn is Editor in Chief at TradingMarkets.com.

Want updates on our latest articles? Have something to say to David Penn or

the staff at TradingMarkets? Follow David on Twitter at @Penn_TM and TradingMarkets at @Trading_Markets. You can also join the

discussion on Facebook by logging onto our fanpage

.