How Forex and Stock Trading Differ

There are many similarities between the stock market and the forex market, but there are also some differences. In this article, I will discuss some of the key differences between the two markets.

Forex Market

The forex market has many names and can be referred to as the retail off-exchange, foreign exchange, forex or just simply FX market. It is extremely liquid, with over four trillion dollars in volume traded every single day. The forex market is open 24 hours a day, 5.5 days a week.

Since forex is a world trading market, different countries’ markets will open and close at different times and thus provide needed liquidity and allow for 24 hour a day trading. The forex markets begin with Japan and Singapore, then Europe, then the United States, Canada and Mexico. As one region’s market day ends, the next region’s market day is just beginning.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® – A Quantified Guide.

If news hits the wire or an event has taken place, you do not need to wait for the market to open, you can trade at any time 5.5 days a week. This is very appealing if you like to trade on the news and want to be able to get in and out anytime you please.

Another advantage or perhaps disadvantage is leverage. Forex allows you to trade from 50:1 up to 400:1 on your initial margin deposit. On the high side, that means that for a margin deposit of $1,000, you can control $400,000 worth of currency. A margin deposit is not the same as what is considered a stock margin account. In forex, the margin deposit can be likened to a good faith deposit used to bind the contract on the purchase of a house. However, in stocks, the margin can be likened to the down payment used to buy the house. Without appropriate use of risk management, a high degree of leverage can lead to large losses as well as large gains.

Stock Market

The stock market in the United States is open from 9:30 AM to 4:00 PM EST. Some pre-market trading can be done between 7:00 AM and 9:30 AM, as well as some after hours trading from 4:00 PM to 8:00 PM. The stock market is open 5 days a week. It is the most liquid during regular market hours. Pre-market or after hours trading has nominal liquidity. If you wish to buy/sell stocks in other countries, you must see if those stocks are available on your online trading platform or if you have to call you broker to make the trade. Most U.S. online brokers or brokers that operate online platforms only allow you to trade stocks that are listed on the NYSE, NASDAQ, AMEX or OTCBB. All stocks are bought and sold on the exchange that hosts that particular company’s stock, so if you do not see that exchange as an option on your drop-down menu, you should call your broker to see if they have the ability to purchase a particular stock on an International Exchange.

News trading can be done during market hours and is difficult to time right. Most major banks and investment banks know when something is happening with the company, since their analysts get the most current information and can post a buy/sell/hold on that particular stock. They will most likely open, close or block trade a position based on their Analyst’s and Portfolio Manager’s recommendation, which is usually before the average person can get in or out of that particular security.

Stock leverage can mostly be utilized when your account value is above $2,000 and comes with a high interest rate against the leverage. It is possible that you would receive a margin call if your stocks dip below a certain percentage of their value, which must be made up or closed out. Margin requirements can be as high as 50% of your available capital to take a position, but should probably never be more than 10% of your available equity.

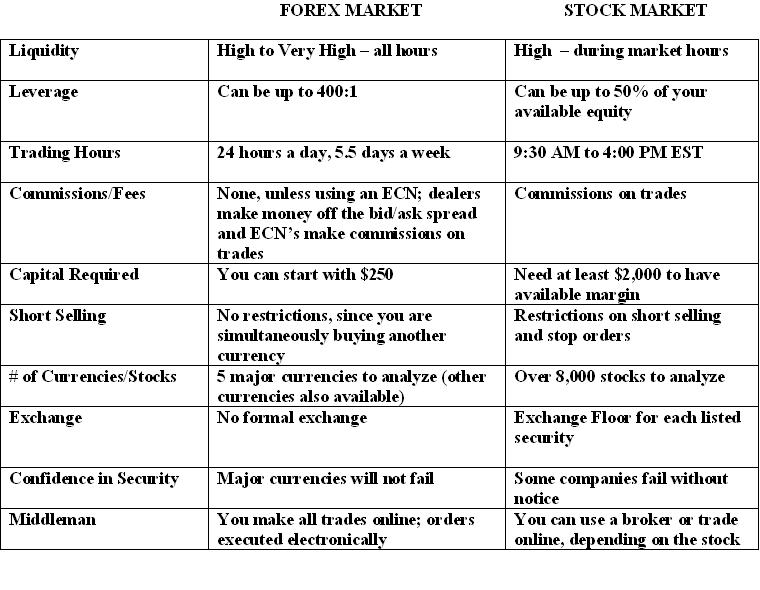

Let’s take a closer look at both types of markets in the chart below:

It is often easier for a self-trader to start with forex as opposed to stocks, if you have limited funds available. This is due to the higher leverage and the ease of only having to track five major currencies. The stock market is finicky and you would really need to analyze each company individually to determine whether or not you should invest in it (cash flow, balance sheet, profit and loss, products offered, products in the pipeline, years in operation, value stocks, growth stocks, emerging market stocks, etc.). A currency is affected by five main things that I like to call “PEPSC” (pepscee):

- Political Events – instability, turmoil or an economically friendly new government

- Economic Factors – deficits and surpluses, inflation/deflation, economic reports

- Psychology of the Market – flight to quality or anticipation of something happening

- Speculation – investing in currencies with higher risk to profit from anticipated price change; can have a negative impact on a country’s economy

- Currency’s Supply and Demand (based on a country’s exporting of goods)

If you can understand these events and how they affect a country’s currency, you can trade forex. Whether you are an experienced trader or just starting out, it would behoove you to learn everything you can about the markets (forex or stock), so you can feel confident in your trading decisions.

John A. Taxiarchos is a seasoned professional investor/trader with over 10 years of experience in the equities, futures and FOREX markets. John started his career as a registered representative for a Top Ten Investment Bank. As trading technology advanced, John shifted focus on trading strategies in the Forex market. He is currently a Market Analyst for Traders Choice FX: www.traderschoicefx.com