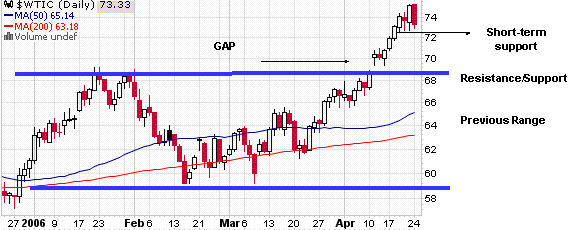

How high can Crude Oil go? This chart can tell you

Now that the Crude Oil price has broken out above its

range of the year, how high could prices possibly go? One way to calculate a

price objective for securities is to measure the range that the security traded

in previously, and then project that distance forward from the top of the

previous resistance. In the case of the continuous crude contract ($WTIC), the

bottom of the previous range in 2006 was at approximately $59.00 and the top was

approximately $69.00.

The $10.00 difference is then added to $69.00 to obtain a new price objective of

$79.00. Once (or if) crude oil prices break above $79.00, a new price objective

can be calculated. The contract closed yesterday at approximately $73.33. Is it

O.K. to buy (the commodity directly or oil related shares) now or should

investors wait for a pullback? To answer this question, it would helpful to know

a downside objective in addition to the upside objective of $79.00 that was

previously calculated.

An impressive point about this chart is the fact that the break above the prior

resistance formed a rising window (or gap). This defines the range even more

definitively and likely establishes a new range for the commodity. The gap

should serve as support on any decline and also the previous resistance at

$69.00 should now serve as new support.

Therefore, you could feasibly use any drop below $69.00 on the close as a stop

point. In order to calculate a real risk reward, you take the price objective of

$79.00 and subtract the current price of $73.33. We have a possible reward of

$5.67. Conversely, we have a possible risk of $4.33 ($73.33-$69.00). The reward

is greater than the risk, but by only a margin of 1.3 ($5.67/$4.33). Going long

a security with a risk reward ratio of 1.3 is not viewed (by me) as highly

aggressive.

However, because some of the other tools that can be used to help determine

overbought/oversold levels are at the top of their ranges, I would prefer to

wait for a little bit of a pullback here. Please notice that since the 19th, the

lows of the contract have not gone below approximately $72.65. This could also

serve as another piece of support and is likely a good buy in point as well. Put

your orders in at slight pullbacks (but not deep retrenchments).

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.