How I Trade Using Both PowerRatings and Fundamentals

As a technical-fundamentalist, I prefer the security of knowing that the stock I’ll trade over the next few days meets certain fundamental and value criteria. Then, if I’m right technically, there will be lots of institutional interest to support my play.

Each weekend TripleScreenMethod.com (TSM) utilizes 16 screens to assess a combination of company fundamentals, earning revision fuel, and remaining value. On completion, 50 to 100 stocks meet the fundamental criteria yet have value remaining at the current price. This group is then traded over the next week utilizing a pullback strategy. TradingMarkets’ PowerRatings offer a powerful technical approach to assessing the quality of the pullback.

Let me give you an example of how well these two approaches work together. I wrote the following in Tuesday’s (4/11/06) TSM report (see included chart for sense of market state): “The S&P is oversold to a degree that historically has produced a bounce back the next day. Larry Connors’ work shows that bounce back occurred 81 percent of the time when the following conditions were met: (1) S&P trading above its 200-day moving average (we’re there); (2) Intra-day makes a 10-day low (we’re there); (3) VIX closes 5% or greater above its 10-day moving average (we’re now at plus 11.5%). Odds favor a bounce tomorrow so I’ve looked for several long candidates in which I’ll try to take profits quickly.”

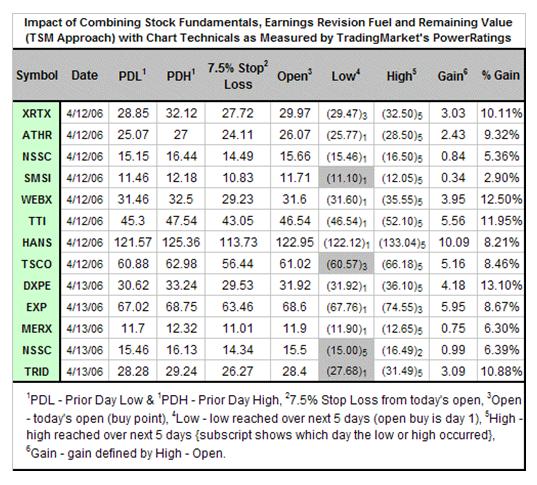

With the state of the market ready to bounce, eight fundamentally sound TSM stocks had PowerRatings of 8 or greater. These were ready to rebound with the market. The strategy was to buy a full position at the open (say 1,000 shares of each — $501,840 for the 13 stocks identified over the next two days), to use a 7.5% stop loss (risk about $38,000), then scale out in 3% gain increments (1/3 of the position at each increment) (~$15,000 gain at each increment).

WEBX, inserted in the below chart, shows how a typical trade played out from the first day (4/12) to the fifth trading day (marked on the chart). The low for the trade occurred on day one, the high on day five-both subscripted in the table. All 13 trades were profitable: buying 1,000 shares at the open and exiting at the high over the next five days would have produced a maximum $46,360 gain, 9.24% average return or 408% annualized (over 221 trading days). Results for all trades are summarized in the following table:

Further observations: (1) waiting for today’s price to exceed yesterday’s high (demonstrate strength) would have reduced the gains significantly (because of the respective fundamentals and the state of the market, I didn’t require this usual restriction); (2) one could have used the prior day’s low as a technical stop loss point to scale out of half your position (four days with shaded lows would have met that restriction).

Obviously marrying a good fundamental approach with a solid technical one can reap benefits. I continue to use this type of approach daily and will report results from time to time. Note: without the oversold market, I require a demonstration of the pullback’s reversal before entering.

Richard Miller, Ph.D. – Statistics Professional, is the president of TripleScreenMethod.com and PensacolaProcessOptimizaton.com .