How Near Is the Bear & 3 Bearish PowerRatings Stocks

It is not a question of if the bears will raise their ugly heads. It’s a question of when. Investors have been blessed with a massive bull market since March 2009. Nearly 12 months of bullish bliss refilling dilapidated long term mutual fund holdings and many retirement accounts. While we experienced a small, sharp pull back over the last 2 weeks, bulls quickly stepped into the fray keeping the Dow Jones Industrials solidly above the technically critical 10,000 level.

The prime movers of this bull surge are low interest rates, companies forcing up earnings via cost cutting, and governmental economic liquidity injections. The ultra low interest rates may be the first of the bull support pillars to break. I am basing this projection on the fact that Ben Bernanke and Barack Obama have been meeting extensively with “Dr. High Interest Rates” Paul Volcker. Volcker was Fed Chief before free market advocate, Alan Greenspan and pushed interest rates above 20% in the early 1980s.

It’s not clear if Volcker is pushing for higher rates, but based on past actions, it’s very possible. Once thing is for sure, in his recent talks at the Economic Club and in a New York Times’ article, he is pro regulation and wanting to give the Fed more power to control the economy. In addition to the Volcker angle, rates can’t go lower therefore any changes will be to the upside. In other words, the bias strongly points toward increased rates in the future. When this will happen, no one knows for sure.

Fortunately, short term stock traders don’t need to worry about when the bear market will re-emerge. Nor do they have to give much concern to the potential of rising interest rates. However, short term stock traders can and do make money by correctly choosing stocks ready to drop and selling them short.

We have developed a simple 3 step plan to locate companies most likely to drop over the next 5 trading days. Remember, these same principles work whether or not an overall market drop occurs or not. In other words, they are stock, not market specific.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

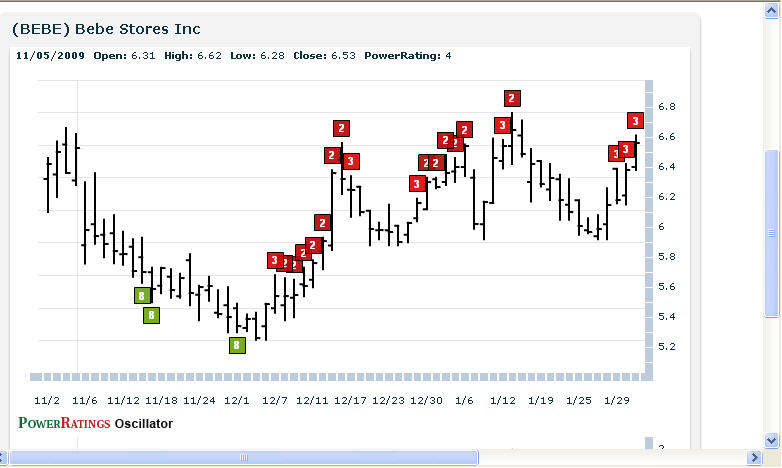

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names prepped for a bearish move soon:

^HTS^

^BEBE^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.