How to Enter Trades at the Right Price

Greetings my fellow traders!

With this article I would like to continue my article series dedicated to some tricks and useful hints in Trading. (Read Setting Up Alerts to Trade More Efficiently by clicking here)

This Article is about an Entry Price selection.

We covered some Entry and Exit points in the previous articles, but in this one I would like to cover an Entry Price selection.

I can summarize it in a very simple rule: “The Entry Price should be at least 5 cents away from the Support or Resistance level.”

As you can see now, we will be looking at the strategy of a break of Support or Resistance levels.

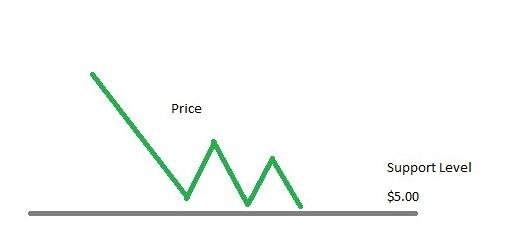

Let’s look at a picture below to get an idea about this approach to the price selection.

As we can see on this picture the price is about to break the Support level at $5.00 mark.

The smart Entry Price for us would be $5.05, which is 5 cents away from the Support Level as we open a Short Sell position.

Why do we want $5.05?

The answer is obvious: If Price goes our way, we will get an extra 5 cents on a Price move in our favor, if the Price will go back up, then we get our Stop Loss at 5 cents less.

The similar situation will occur when we open a Long position anticipating the Price to break through the Resistance level.

Both points are very important to us.

I hope this little trick will help you to maximize your profit and minimize your losses in Trading.

Happy Trading!

Roman Larionov is the founder of the Absolute Resolution Project, managed by the Absolute Resolution Consultants – New York based consulting company established in 2007. He has 12 years of experience including senior and executive management positions, project management, revenue management, sales, product development, people management and customer service. His trading experience includes 8 years of trading FOREX and NYSE equities.

Mr. Larionov holds two Bachelor’s Degrees in Management and Management of Crisis Situations along with the MBA degree in International Business.