How to Trade Exchange Traded Funds in a Volatile Market

As we all know by now, this is a trader’s market. The current volatility, fueled by onslaughts of reports from the financial arena – both terrifying and optimistic – has caused our stock market to explode missile-like, then implode, just as fast.

These moves take place from one day to the next, one hour to the next… and even, it seems, from minute to the next.

If you want to trade in this skittish, jittery, emotional market (novices are strongly advised to wait it out on the sidelines), you can do so more easily – and with less risk – by simply trading the exchange traded funds (ETFs) that represent, to what I call, the “Focused Four.”

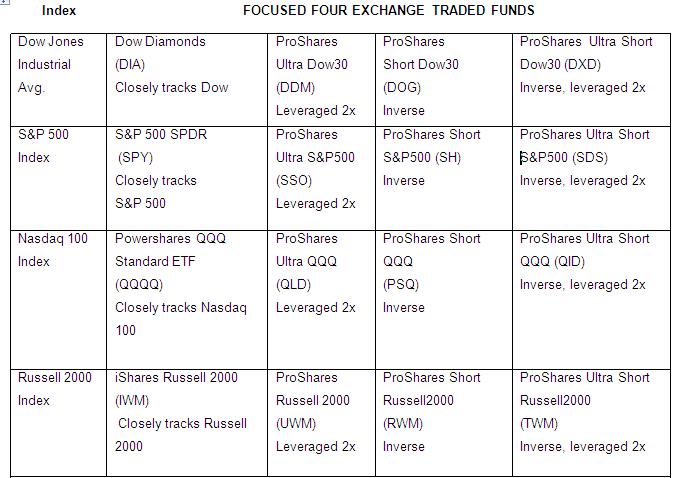

As you can see in the table below, each of my Focused Four group of exchange traded funds include a combination of four ETFs that track four of the market’s major indexes: the Dow Jones Industrial Average, the S&P 500 Index, the Nasdaq 100 Index, and the Russell 200 Index. These indexes are easy to track and trade.

Unless the market is chopping sideways (which is a good time to pack up a cooler and head to the beach), you should always be able to find a trade within one or more of the fund groups.

Table 1 – Focused Four Exchange Traded Funds

Focused Four with Trading Strategies

Each Focused Four combination offer four ETFs that correspond to the major index listed. In the Focused Four table, the first column lists the index.

The next column lists the standard tracking ETF for that index, such as the ^DIA^, which closely tracks the Dow Jones Industrial Average, and the ^QQQQ^, which closely tracks the Nasdaq 100 Index.

Strategies: When one or more of the major indexes moves in an uptrend (or downtrend), the standard tracking ETFs serve as dandy vehicles for all trading time frames, whether intraday, swing, or trend. (Of course you can sell short any of these ETFs.)

The third column shows leveraged ProShares ETFs for each index that offer twice the bang for your buck. These shares, such as the ProShares Ultra S&P 500, move 2% for every 1% move taken by the underlying index. When you trade these funds, you gain (or lose – so be careful) twice as much as you would trading the same equity in the standard tracking ETFs.

Strategies: When one of the major indexes listed is trading in a strong uptrend, I buy shares in its leveraged ETF to take advantage of the upward momentum.

On a more conservative note, I may buy 1/2 position in the standard tracking ETF for that index, and fill the remaining position with leveraged shares, to help boost profits.

The fourth column shows inverse ProShares ETFs for each index. These are great for hedging in IRAs, since when you buy shares in these funds that you are actually short the corresponding index. Two examples shown in the table include the ^PSQ^, and the ^RWM^. Please take care when you initially start trading these shares. It takes practice to wrap your brain around the reality that your fund is moving in the opposite direction of its corresponding index – and that when you buy inverse fund shares – you are short the market.

Strategies: A major index roils through a top reversal pattern and heads into a downtrend. You buy corresponding inverse shares and profit from the downward move, selling your shares when the downtrend shows signs of upcoming recovery. Or, you can hedge long-term positions in your IRA by buying shares of the inverse ETFs. For example, your IRA holds a large portion of technology shares. You buy shares of the ProShares Short QQQ (PSQ), which means you are short the Nasdaq 100. Naturally, you take profits by selling the PSQ position when the Nasdaq 100 reaches nearby support, or shows signs of bottoming.

The fifth column lists leveraged, inverse funds that relate to each index, such as the ^DXD^, which moves 2% higher or lower than the Dow, and in the inverse (opposite) direction.

Strategies: Any of the four indexes shown begin to teeter and fall into a sharp down trend. You purchase shares of the leveraged, inverse funds in order to profit from the move lower. Just as in the earlier example with leveraged funds, you can trade a more conservative path by putting 1/2 your position in an inverse fund, and the remaining 1/2 in a leveraged, inverse fund. Of course, you can also use these leveraged, inverse funds to hedge long, long-term positions by buying shares that relate to your stock holdings.

Figure 1 below shows a daily chart of the standard tracking ETF for the Nasdaq 100, the Powershares QQQ (QQQQ). Compare it to Figure 2, which displays a daily chart of the Nasdaq 100’s ^QID^. Note how the QID makes bigger moves (2x leverage does that!) than the standard Qs, and how it moves up when the QQQ heads lower.

Figure 1 – Powershares QQQ (QQQQ) Daily Chart

RealTick © graphics used with permission of Townsend Analytics, Ltd. © 1986-2008 Townsend Analytics, Ltd.

Figure 2 – ProShares Ultra Short QQQ (QID) Daily Chart

RealTick © graphics used with permission of Townsend Analytics, Ltd. © 1986-2008 Townsend Analytics, Ltd.

Remember, when using any ETF, plan your trade before you enter. Become thoroughly accustomed to how leveraged ETFs move – again, before you trade them. That caveat goes double for leveraged, inverse ETFs. Never hedge a bad trade. Finally, always set your protective stops just after you enter.

The Focused Four offer you a broad combination of ETFs that correspond to the major indexes, the Dow Jones Average, the S&P 500, the Nasdaq 100 and the Russell 2000. More often than not, one or more of these ETFs pegged to overall market action, will offer you a solid, profitable trade!

Toni Turner is a trader and investor with seventeen years of experience in the financial markets. She is the best-selling author of A Beginner’s Guide to Day Trading Online 2nd Edition, A Beginner’s Guide to Short Term Trading and Short-Term Trading in the New Stock Market. Toni has appeared on NBC, MSNBC, CNN, and CNBC. She has been interviewed on dozens of radio programs and featured in periodicals such as Fortune magazine, Stocks and Commodities, SFO, MarketWatch, Fidelity Active Trader, and Bloomberg Personal Finance. Toni is also the President of TrendStar Group, Inc. For more information about her live and online seminars, as well as additional educational products, please go to www.ToniTurner.com