How to Trade Futures Along With the Smart Money

I think we’ve all heard that 90-95% of futures traders blow up their trading account. How does that make us feel? These statistics may prevent some people from even trying. But is it possible to use these numbers to our advantage?

One of the most important concepts to understand regarding trading is that “the public” is always wrong. This can be useful information, however. To quote Larry Williams, “There is one little problem… WE are the public!”

Click here to order your copy of The VXX Trend Following Strategy today and be one of the very first traders to utilize these unique strategies. This guidebook will make you a better, more powerful trader.

In other words, we have to fight the traditional trading and investing programming that we’ve listened to our whole lives! We will no longer follow the herd; traders are mavericks. Therefore, don’t expect to win popularity contests in online trader chat rooms. Most of the these chat rooms are filled with paper traders who have yet to put money in the markets and who love to talk about the trades they “did” and how bright they are. If you feel a need to hang out in these chat rooms, I would suggest you enter these rooms to determine what trades most of them are taking and take the other side!

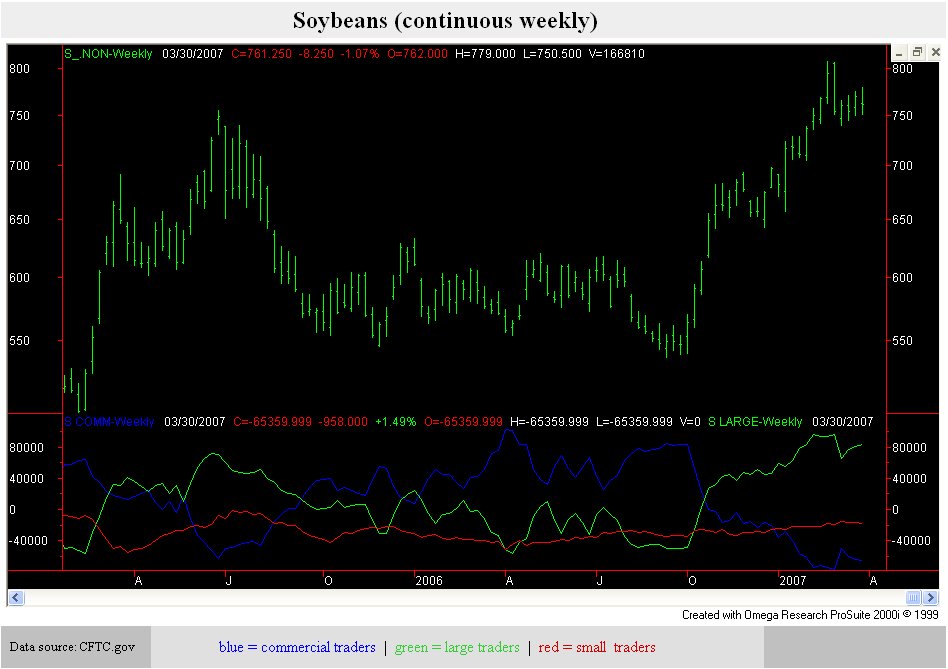

This may sound strange to you if you haven’t heard this before but we have to be a contrarian. If this philosophy is hard to swallow, consider the following facts. The Commodity Futures Trading Commission publishes a report every week called the Commitment of Traders (COT) report. The report is sometimes referred to as legal inside information due to the fact that any futures trader that holds a reportable position overnight has to inform the government. Reportable positions are open futures positions that are sizable and not typical of a small retail traders position.

From the COT data, we are able to determine what the net positions are for the large commercial traders and the small retail trader. Sometimes there is no significant difference between the commercials and the small traders (the public.) However when there is a significant difference, pay attention!

For example, let’s imagine that there has been a bearish trend in soybeans for the past six months. We look at the Commitment of Traders report and it says that the small retail traders are significantly more short than long. In fact, they haven’t been this short for about two years. Now we turn to the commercials and their net open positions. The COT states that the commercials are significantly more long than short, and they haven’t been this long for two years. This is useful information as the commercials and small retail traders are polar opposites at this point. Guess who is going to win this fight? Remember the golden rule? The one with the gold makes the rules? Yes, the commercials always win and the public is always wrong.

When you see the charts to prove the above COT example, you truly will become a believer in the fact that the public is always wrong! Armed with this contrarian information, we can give ourselves an edge when it comes to trading futures, and it will help us avoid staying in the 90-95% club.

Ross Beck, FCSI (AKA Mr. Gartley) is a Fellow of the Canadian Securities Institute and world renowned public speaker on technical analysis. Ross writes The Climb newsletter for Majestic Peak Trading and the Gartley Trader newsletter at gartleytrader.com. Click here for more information.