How to Use Average True Range for Short-Term Trading

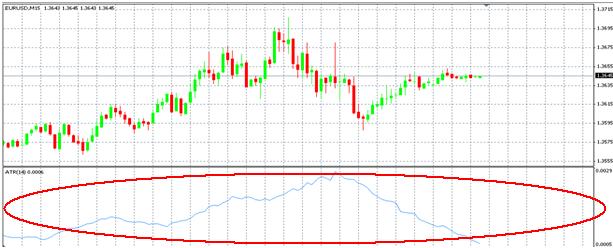

Average True Range (ATR) is a very useful indicator that measures the overall price volatility. However, the ATR indicator is often overlooked by various traders because of the way it is displayed:

In addition to how it is displayed, many forex traders find issues with the actual indicator. Since ATR is based off the price movement and not percentage value, it is hard to compare ATR measures between different pairs. Another issue many traders have with ATR is that there is no specific benchmark for when to buy or sell. Despite all these issues, ATR still proves to be a very useful indicator. There is a simple solution to the problem most traders have with the indicator and to fully utilize ATR we need to use it in conjunction with another very common indicator.

Moving averages are a useful and common indicator that many traders use. In this case a 10 period simple moving average (sma) will be used to trigger entry positions. Below are the additional rules for entering our trades:

Entry Rules:

- The price must cross over the moving average line and close on the opposite side

- The trade’s direction will be determined based on the direction of the cross;

- a long position when the price crosses from below and closes above the moving average

- a short position when the price crosses from above the moving average and closes below

- A trade can only be placed if it coincides with the current trend;

- a long position must have a positive moving average slope

- a short position must have a negative moving average slope

- no trade should be placed if there is a flat moving average slope

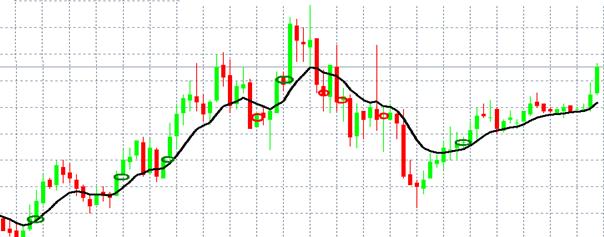

With these parameters in place, we are given the following trade signals:

Although it appears that several valid trade signals have been generated, you still need to determine when and where to exit these positions. In order to do this you can use a variation of a moving average channel, one that is based off of the ATR.

The channel seen above is created by offsetting the moving average by a factor of the current ATR in both the positive and negative direction. You can use this channel to make your primary decisions on exiting your position. We base this off of the theory of mean reversion, with the assumption that when the price moves beyond a certain ATR range it is likely to reverse. It is important to note here that past performance are not indicative of future results. In this example, the two critical levels that will be used are the 1 and 1.5 ATR values.

The closest channel to the moving average represents a value of 1 ATR. The outer channel represents the 1.5 ATR level and will used as our target exit point. Based on where the price is in relation to the ATR channels, we are able to determine our additional exit conditions. Below is a list of exit rules.

Exit Rules

- The position will be closed if the price crosses the moving average to the side opposite of the entry position and reaches the 1 ATR level on that side.

- The position will be closed if the price crosses the moving average to the side opposite of the entry position and closes on that side.

- The position will be closed if the price reaches the 1.5 ATR level.

- The position will be closed if the price crosses the 1 ATR level on the entry side and closes:

- below the 1 ATR line for long position

- above the 1 ATR line for short position

Based on our entry and exit conditions, we would have seen the following results:

Typically this strategy works best in a trending market however it is still able to be applied overall market conditions. Additionally, the longer the time frame used, the more accurate this strategy has been in the past. Again, historical results are not indicative of future performance. There are many variations to this strategy that can be customized to a particular trading style. In particular, the use of a different type of moving average or a longer time frame for the moving average can greatly affect the overall strategy, specifically the frequency of your entry signals. When used in conjunction with proper money management skills and rigorous discipline, this strategy provides a unique opportunity that can lead to potentially successful trade set ups.

Matthew Cherry is a forex market analyst for TradersChoiceFX.com. Many more of his latest articles can be found on the TradersChoiceFX Forex Blog. You can download a free Metatrader Practice Account from TradersChoiceFX and get instant access to a special report that will teach you how to use a Forex bonus program to improve your success as an FX trader.