How to Write Covered Calls

Covered call writing (or selling) involves selling one call option for every 100 shares of stock that you own. The covered-call strategy can accomplish 2 purposes:

- The premium received can increase the rate of return by providing income on the position.

- The downside risk of owning the underlying stock can be reduced since the premium acts as cushion for the underlying stock’s downside movement.

It is crucial to realize that when you write a call against your stock position, you limit your upside potential. No matter how high the stock rises, you have established a maximum selling price for your equity holding. That maximum price is equivalent to the strike price of the call, plus the premium that you received. Therefore, on a sharply moving stock you may experience an opportunity loss.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® – A Quantified Guide.

The covered call writer should always be prepared to have the call exercised and his stock sold at the exercise price if the underlying stock trades above the strike price. In practice, a call is usually exercised when it has minimal time value, usually if the option is near expiration or deeply in the money.

The risk in this strategy develops if the underlying stock declines by more than the amount of the premium received. At this point, the premium no longer protects you against further losses. Of course, such risk is present for any long stock position.

There are a variety of reasons that you may choose to sell covered calls. The successful covered call writer chooses a specific call to sell based on his expectations and objectives. There are 2 major factors that you should consider before writing a covered call:

- Your expectations for the underlying stock

- Your particular strategy objective

If you expect the underlying stock to rise, your objective may be an above-average return – a combination of premium income and any appreciation of the stock price up to the strike price. Thus, if the call is exercised, you have met your objective.

If you expect the stock to remain stable, your objective may be to generate cash flow or produce income on a dormant position.

If you expect the stock to decline but are unwilling to sell out the stock position, your objective may be to offset some or perhaps all of the loss on the stock.

In order to decide which call to write (sell), you must have a clear understanding of the relationship between the current market price of the underlying stock and the exercise price of each call and how that will affect your strategy. This relationship is defined in 3 ways:

Out-of-the-money: The strike price of the call is higher than the price of the stock. Because the strike price is higher than the stock’s current price, you will receive the smallest premium for an out-of-the-money call and therefore get the least downside protection with this type of call.

However, the out-of-the-money call provides you with the opportunity for upside potential on your stock because you can profit on a rise by the stock all the way up to the strike price of the call. Therefore, when you sell an out-of-the-money call, you establish a selling price for your stock above the current market price and the premium increases the total return. This type of call may be well suited to the trader who expects a moderate rise in the price of the stock.

At-the-money: The strike price of the call is at or near the price of the stock. Because the stock is trading at or very close to the strike price, you will receive a higher premium than the out-of-the-money call option and moderate downside protection. If the stock declines, you retain the premium as a profit, whether or not the call is exercised.

In-the-money: The strike price of the call is lower than the stock price. Because the stock price is above the call’s strike price, you would receive the largest premium for an in-the-money call and the maximum in downside protection.

A willingness to have the stock called away is a very important consideration in planning a covered-call strategy. The higher the price of the stock in relation to the exercise price of the call, the greater the chance of an exercise. Thus, you incur the greatest likelihood of having your stock called away when you sell an in-the-money call.

Here are a couple of other points to keep in mind:

- If you are strongly bullish on the stock, it may be better not to write an option against it so that you have unlimited upside potential.

- If you are strongly bearish on the stock, it may be better to simply short the stock or sell out the long instead of trying to hedge it at all.

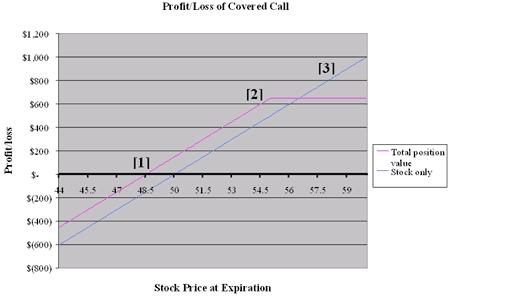

The chart below compares the profit/loss lines of a straight stock purchase versus a covered call. In this example, the stock is at $50 and a 55 call is sold for $1.50 per option, or $150 per contract. Note that:

- The breakeven for the covered call ($48.50) is less than the stock position’s breakeven by the amount of the premium received ($1.50).

- The maximum profit for the covered call is $650. This is comprised of the stock’s appreciation to 55 ($500) and the profit of the call’s premium ($150). A capped gain is the major drawback to this strategy.

- The maximum profit for the stock position is unlimited.

Jocelynn Drake is an analyst and financial writer in the research department at Schaeffer’s Investment Research. Ms. Drake’s comments have appeared in several media outlets including the Dow Jones Newswires, CBS MarketWatch, and Reuters.

Click here to sign up for a free, online presentation by Larry Connors, CEO and founder of TradingMarkets, as he introduces The Machine, the first and only financial software that allows traders and investors to design and build quantified portfolios.