If you’re looking for fireworks today, watch these levels

It’s been a rather dull week so far…

profitable, but dull. No large range days or big moves overall, just a gradual

dribbling lower in the tapes. We are not likely to see fireworks on the last day

of option expiry ahead of next week’s FOMC meeting, but anything is possible

when it comes to financial market behavior.

ES (+$50 per index point)

S&P 500 traded into 1237 sell triggers

yesterday, then chopped its way slightly lower before going sideways into the

close. Another small-range day and morning move, afternoon consolidation.

1237 should again offer pivotal resistance =

support today. Short below and long above 1237 is the general bias, with 1241

last line in sand for sellers.

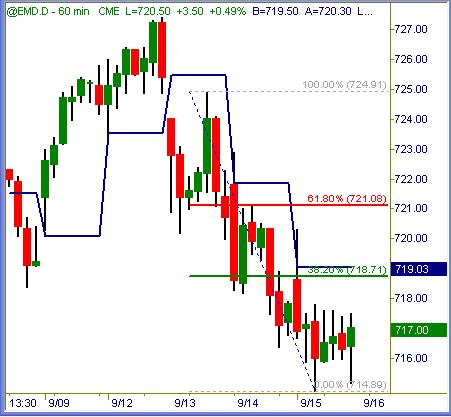

MD (+$100 per index point)

S&P 400 also posted a very muted session. Quick

stab lower in the morning led to sideways fuzz in the afternoon. Look for high

718s to be layered resistance again today, and break above potentially bullish

from there.

YM (+$5 per index point)

Dow Industrial futures hit their sell signal

near 10620 and worked downward to 10560 by midday. Miniscule intraday range by

any account… perhaps we’ll see better today but more likely next week.

ER (+$100 per index point)

Russell 2000 futures dropped and coiled along

with other emini symbols Thursday. a revisit to yesterday highs will probably

cap the upside today, otherwise we could see sideways to higher action above

there.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

Today is equity option expiry. Possible to have a big day, but not

probable. Next week is the much awaited FOMC meeting where a growing number of

traders feel rate hikes will pause or end. Regardless of the outcome,

expectations may keep stock markets sideways to higher until then. Could be a

landslide sell-off if stocks are propped with expectation of no further rate

hikes, and the Fed keeps raising right along. Should be an interesting event

across all financial markets, to say the least.

Pleasure & Pain

Living things exist and survive by the dual acts of seeking pleasure while

avoiding pain. Accomplish those simple tasks and procreation exceeds attrition.

Simple as that.

New traders are in full pleasure seeking mode

when first getting started in the game. Plans for quick profits, massive wealth,

a fun-filled trip to all material things in life are sugarplums dancing in our

heads. We are warned about the dangers and pitfalls of trading, but who has time

for that? We’re way too busy reveling in our pleasure mode to even consider

dealing with potential pain.

Let a few of those trade decisions turn to

financial losses and the entire emotional outlook shifts 180 degrees. We go from

pure pleasure mode of fantasizing about all good things to the pain of fearing

all bad things instead. It is not a dramatic shift… usually a subtle evolution

that sneaks up on us in direct parallel to our account’s equity curve ride.

Part of avoiding pain is to distance oneself from

disappointment. Once we have experienced some challenges in any pursuit, natural

defense mechanisms kick in. We are taught from an early age to “keep it real”

and “don’t get our hopes up” while “not counting your chickens before the eggs

hatch.”

“Seeing is believing” would be the

biggest false cliche` I can think of. “Believing is seeing” would be the natural

order of progression. When traders begin to make excuses on why they cannot

succeed, their planned failure becomes reality. When traders visualize and

expect trades to lose, guess what happens? They do!

Fear is nothing more than inverted faith: it is

expectation of evil rather than good. We can far easier train ourselves to be

losers than winners although the overall process is equal.

You Are What You Think

Positive thoughts, realistic expectations and setting solid goals to succeed

are the foundation of any successful venture in life. Shortcuts, false

expectations and flying by the seat of one’s proverbial pants is the path most

humans take thru any venture in life. The former is mandatory for methodical,

sustained success. The latter is justified with negative thoughts, excuses and

outright lies to oneself.

If one single person can succeed as a trader,

ANY person can therefore do the same or better. That is a universal law, not

merely my opinion. Yes there are valid reasons why each of us meet up with

challenges or outright failures along the way. Whether we cease trying to

succeed and turn our attention elsewhere or remain focused and accomplish our

goals in the end BEGINS by how we speak out loud within the confines of our own

mind.

Profitable trading requires three basic

things:

1. Method or system with favorable outcome expectancy (greater profits than

loss)

2. Sufficient capital to survive inevitable troughs in equity performance (drawdowns)

3. Sufficient emotional control to operate method or system profitably

Of the three pillars to success, first two

factors are simple enough. There are literally hundreds if not thousands of

systems and methods that offer profit potential when operated correctly. Enough

money to work with either exists or it doesn’t, no two ways around that.

Sufficient emotional control to learn a method

intimately or operate a mechanical system thru deep drawdowns and strings of

consecutive losses is the line in sand between success or otherwise for traders.

Deep down we all know that our future trading performance depends squarely upon

our own decisions. For some, that is a frightening reality. We must decide what

methods or systems to trade, what markets, when to buy or sell, when to let a

100% mechanical system keep hitting new historical loss levels, etc.

There is no magic secret, no Holy Grail, no way

to avoid the painful reality of self-reliance and performance in the markets.

Thousands of traders spend millions of dollars each year chasing such false hope

and siren’s song. This endless equation will never change… every new claim

that hypes the ability to bypass any form of pain (learning curve, making

mistakes, string of losing trades, etc) will attract throngs of willing buyers.

Offers to teach traders how to succeed thru time, effort, patience and diligence

sell much slower and fewer copies than the false hype & hope. I can personally

assure you of that.

Next week we will cover in some detail the

thoughts and actions necessary to succeed as profitable traders. See you in the

weekend educational post before then!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.