If you’re looking for today’s trend, watch these levels

Pre-market futures are green as we begin

the unofficial start of autumn 2005 trading season. Volume should gradually

increase from today going forward, and all we ask is a continuation recent

market behavior to continue into the year’s end or beyond!

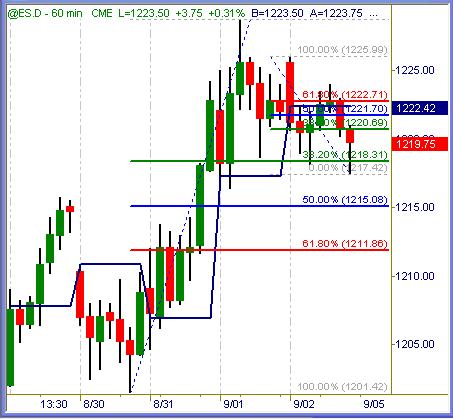

ES (+$50 per index point)

S&P 500 spent the past two sessions

consolidating its most recent move upward. Right now we see 1223 and 1211 as the

range of containment for sideways action. Above or below these respective marks

would signal new directional action may be underway. Watch for either of these

values to act as price magnets if touched, and tested one or more times from the

opposite sides if broken.

NQ (+$20 per index point)

Nasdaq 100 needs to break 1584 upside or 1569

downside to begin a new directional push either way. Very small recent range:

total of $600 per contract entire span for the past four sessions complete.

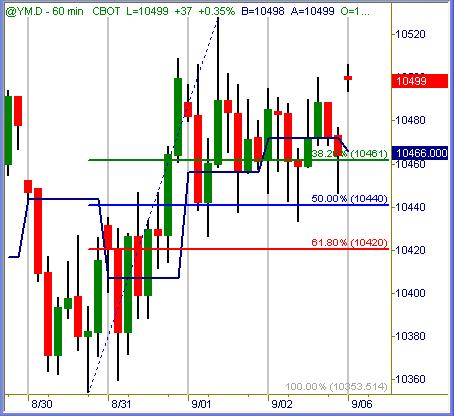

YM (+$5 per index point)

Dow Industrial futures have pretty much wedged

price action into a messy pennant or flag pattern (not drawn) that should

resolve itself soon. 10420 is lowest level of support, while 10460 is probable

to bounce the tape if touched.

ER (+$100 per index point)

Russell 2000 futures have recent resistance

near 667.50 and then 672, while 661 and 658.50 are the lower levels of

short-term support right now. Price action may remain contained between two red

lines… breakout mode above or below would be likely.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

The recent emotional effect from Katrina has spilled over into all

facets of financial markets, including commodities, currencies and financials.

Today may mark a key session as to whether stock prices are headed higher or

lower in trend fashion. This week could be pivotal for the next month or two,

but as usual we’ll trade our method signal setups long or short accordingly and

let the collective tapes’ settle where they may. Excellent action for intraday

emini traders recently… may the markets keep this up forever more!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.