I’m Looking To Re-Establish A Short In This Pair

We closed our short last week in AUD/CAD for

a nice profit of roughly 60 pips. While we are never discouraged by taking

profits, we felt as though there was more to the trade, but technical studies we

follow suggested that we be prudent.

Nonetheless, our macro viewpoint has not changed a bit,

and with the technical picture weakening yet again, we are looking to

re-establish a short soon.

-Â While the Bank of Canada is one of the most

unpredictable Central Banks in terms of monetary policy, the odds of a further

25 bp hike in June seems likely, 25 bp in May, while not priced in, it also

possible if data remains strong and CAD does not appreciate too much in the

interim. Unlike Australia, where another 25 bp hike is seen, they are nearing

the end of their tightening policy, whereas Canada is likely at beginning of a

period of tighter money.

-Â With narrowing interest rate differentials likely

between Canada and Australia, and the prospect of slowing commodity prices (via

rate hikes in the US that are sure to slow growth going forward), AUD/CAD is

poised to test lower levels.

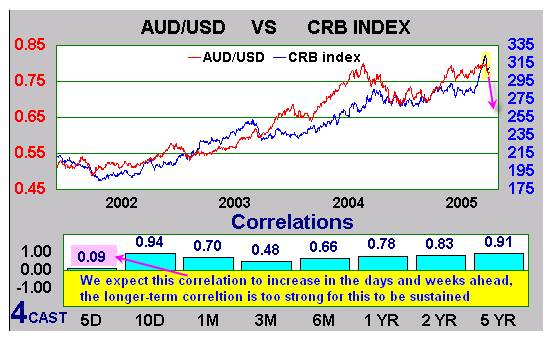

Note this correlation

study between the CRB and AUD:

Source: 4Cast, notations in ‘Pink’ — Aspen Trading Group

Â

-Â The Australian dollar tends to weaken versus the

Canadian dollar when global growth is decelerating, of which there are tentative

signs currently

–Â Â Â Â Â Â

The large current account deficit in

Australia, versus a current account surplus in Canada should also weigh on the

cross. The FX markets have continued to flip flop between tow main themes we

have discussed extensively here; current account deficits and interest rate

differentials. Clearly Canada has the edge going forward on both fronts

-Â There is simply a far

higher level of speculative long positions in AUD relative to CAD. While this

is by no means an indicator in and of itself, we feel it dovetails in with our

analysis noted above.

Dave Floyd