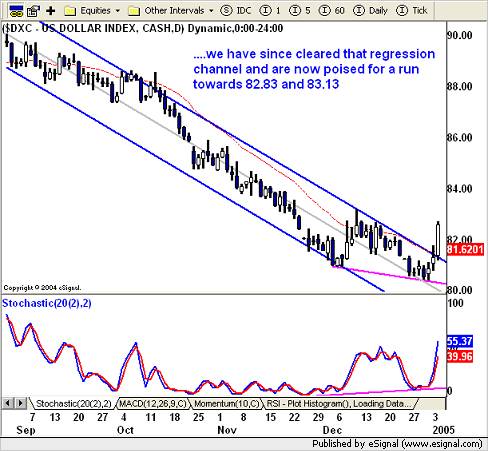

Look At This Chart Of The Dollar

With

the dollar (DXC) off to a great start for 2005 and officially taking

out a bearish trend-channel at 81.40 today, one has to conclude that this might

be more than just a technical bounce.

Â

Â

If this continues to play out,

let’s explore some other themes that build upon this and add some solid macro

evidence for long dollar positions.

Â

Current Account Deficits

2004 was the year of the ominous twin deficits in the US. With record low

yields at the beginning of the year on top of that, the dollar was not a viable

currency to own. Since then however, rates have moved higher on the short-end,

although backed off on the long end mainly due to Asian Central Bank buying.Â

What has been overlooked, up

until now, mainly due to the attractive interest rates on overnight money, is

that the deficits, as a percentage of GDP in Australia (-6.7%) and New Zealand

(-5.8%) exceeded the US (-5.5%). Higher overnight rates in 2004 and firmer

commodity prices kept AUD and NZD well bid.Â

Â

Â

With rate differentials between

the US, Australia and New Zealand contracting and commodity prices falling, the

recent rout in NZD and AUD may just be the beginning.

Â

Open Trades:

Â

Short NZD/JPY from 73.70

Short NZD/USD from .7130

Long EUR/CHF from 1.5320

Â

As always, feel free to send me

your comments and questions.

Â