Low Riding With the VIX & 5 Bullish PowerRatings Stocks

I can almost hear the late Biggie Smalls rhyming and beat boxing to the title of this article. While a low riding VIX isn’t a likely rap song subject, it is a subject every investor needs to understand.

What is the VIX? The Volatility Index or VIX was first put into practice in 1993. It is built upon a paper written by Professor Robert Whaley. The index measures the implied volatility of the S&P 500 over the next 30 days. Specifically, it is a weighted blend of prices for a range of options on the S&P 500.

These options are priced based on the expected volatility or price changes over the next 30 days. In mathematical terms, the VIX is the square root of the par variance swap rate for the next 30 days. I know that’s a mouthful, an easy and usable way to think of it is the number represents the expected percentage move of the S&P 500 over the next 30 days on an annualized basis. This figure has been as low as 9% and as high as 89% since the VIX was started.

The VIX or Volatility Index has truly been low riding recently. Despite 2 brief pops up to the 40-day Simple Moving Average, the index has been in a serious downtrend since its high of 89.53 in late 2008. This is thought to reflect the fact that investors are becoming more and more confident about the stock market thus putting their money to work.

Some analysts even call the VIX, the S&P 500 upside down. Take a look at the charts and you will see what they mean. Taking a quick look at the weekly VIX chart, it is clear that major resistance to further declines rests at 15. This line has been tested 3 times in the last 3 years and appears to be getting ready to be tested again.

Will this fourth test hold, sending the VIX higher and the stock market lower very soon? No one really knows for certain. It is certain that the market is at a critical juncture right now in regards to the VIX. My opinion is that the 15 level will be broken on this fourth attempt with stocks possessing much more upside potential this year. In other words, I remain quite bullish.

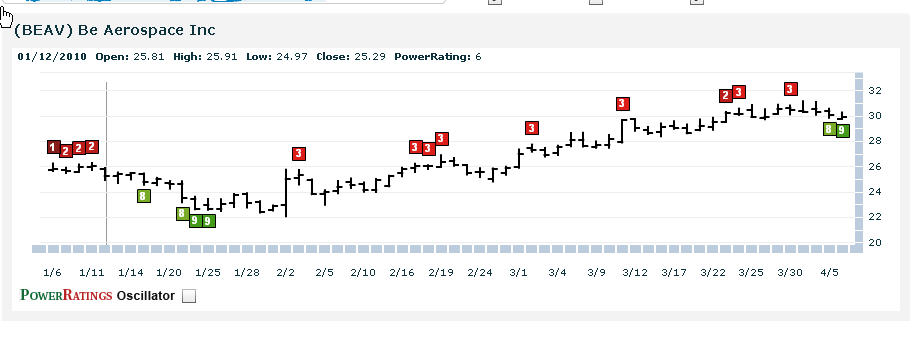

Here are 5 top ranked PowerRatings stocks for bullish short term investors:

^TGI^

^TASR^

^NWY^

^BEAV^

Adeona Pharmaceuticals ^AEN^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.