Majors Contemplating The Next Move After USD Hammers Them

The USD over the last month took a page out of the 18th century French Novel (Les liaisons Dangereuses) delivering what the famous saying proclaims, ‘Revenge is a dish that is best served cold.’

During this time, the USD averaged about a 6.6% gain against the bloc of majors with the smallest gains against the JPY (2.5%) and the largest against the AUD (10.5%). This is the first real set of gains the USD has delivered in quite a long time and the average time it took to create those gains was twice as large as it took for the USD to take them back. Ironically, the timing of the USD bull run is worth noting considering it started to make these major gains within one week of the Credit Crises sell-off we saw late last summer. July 26th was the general day of doom where pairs started to sell-off in enormous amounts. This is not a common phenomenon in all markets as sell-offs are far more violent then buy-ups. However, most ends to bull runs take far longer to manifest then to begin.

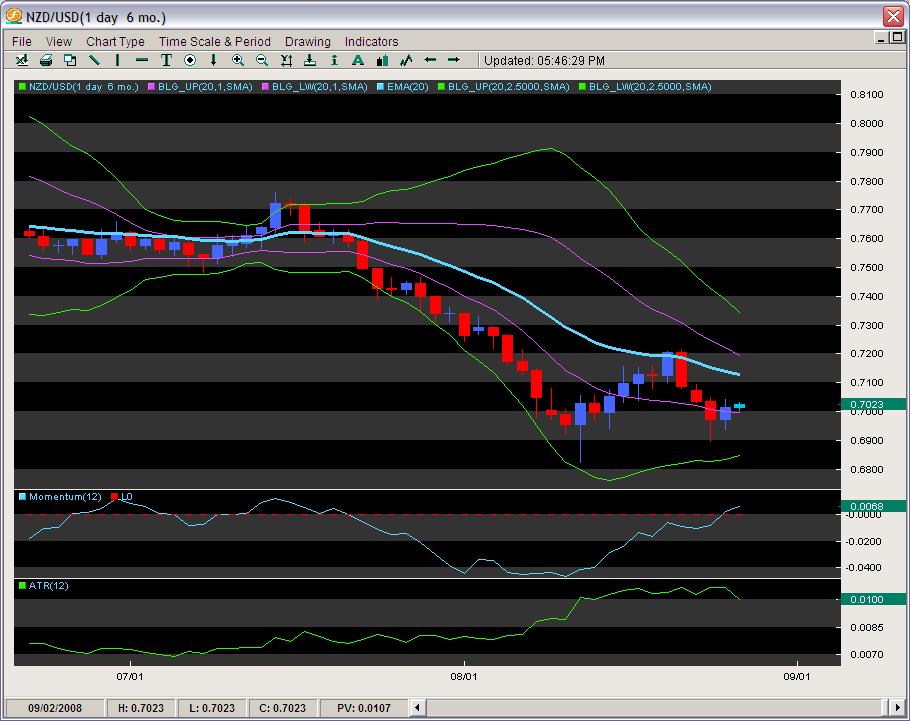

Be that as it may, so far all but two of the G7 countries have exited out of the Bearish/Bullish Bollinger Pockets (1 & 2.5 STD) they were all in for the last month. Out of the group, only two have produced topping/bottoming formations with higher highs or lower lows – that being the NZD/USD and the USD/CAD. This could be directly related to the performance of commodities as of late, but it is not the interest of this trader to speculate on such ventures (key work being speculate). This trader is only looking at the charts and there are some interesting things to note.

First of all, our 2.5 STD Bollinger Bands have contracted on everyone of the pairs with the tightest being the USD/CHF and the USD/JPY. That is because they were the weaker performers for the USD while the real work-horses made strong gains against the anti-podean bloc (AUD and NZD), the EUR and its big brother GBP. Only the GBP is expanding one of the bands but every other one is contracting.

What this means is we should probably expect the markets to consolidate for the next week or so and it’s time to shift gears out of hard trending strategies and look for retracement, range or fade strategies. Our chart below illustrates how so far, the strongest bounce and hold against the USD has been from the NZD which appears to be once again leading the pack. It is currently posting a 2.8% gain against the USD since hitting its 6 months lows sitting at .7024 at this writing.

What is more interesting is it has created a DBL Bottom Bollinger Buy pattern whereby it pierced the lower band towards the end of the move, bounced, re-attacked but never pierced the lower band again. Since the 2nd attack, it has had a decent up day closing inside the 1STD band and with the really strong 12 period momentum still diverging and pointing up; it looks set to retest the 20 EMA about 100 pips above. A break of the 20 EMA targets 72 and 73 cents which is still 200-300 pips away offering some strong fades or retracements.

Generally in situations like this, the upper band is modestly challenged so you can take 1st profit at the 20 EMA or recent swing high at 7209 and have your second target just shy of the upper band. ATR is also starting to produce new lows suggesting volume is paring back contemplating its next move.

Chris Capre is the Founder of Second Skies LLC which specializes in Trading Systems, Private Mentoring and Advisory services. He has worked for one of the largest retail brokers in the FX market (FXCM) and is now the Fund Manager for White Knight Investments (www.whiteknightfxi.com/index.html). For more information about his services or his company, visit www.2ndskies.com.