Managing FX Trades, Part 2

When I wrote yesterday’s

article regarding how to manage open positions, I had done so based

on an extension of some reading I am doing currently. Little did I know that

my/our existing open positions would perform in such a manner in the following

24 hours so as to allow for a real-time analysis of yesterday’s theme.

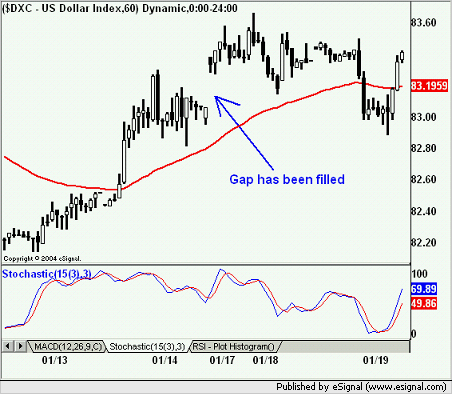

As we all know, the dollar index gapped higher on

Monday afternoon after the holiday weekend. The data that was released was also

dollar positive, but the gains, after the gap opening, were somewhat

disappointing. Nonetheless, the DXC closed above 83.20, a level we still view

as key support.

Overnight however, the dollar got whacked. It

quickly sold off to 83, just a below the close on Friday at 83.06. I had

suspected (in emails sent to my

FX Service that the index may simply need to fill that gap before

deciding where it would go from there.Â

It appears this proved correct. Nonetheless,

when I rolled out of bed very early this morning, I was a bit disappointed to

say the least. Nearly all the gains realized since opening some “long” dollar

positions last week were gone and then some. Mentally, that is tough to deal

with, however, the FX market, at least in the way I approach it, is not an arena

where you let that stuff throw you off course. I simply chalked the move up to

a fill the gap situation. Additionally, economic numbers released at 5:30 AM

were dollar positive. The dollar has since made a fantastic comeback, now

trading just under 83.40 (another key level).

The bottom line, despite being rattled this

morning nothing had really changed in terms of the analysis I had done to choose

these trades. My stop losses are in place for a reason, and while they may be

altered going forward, a sell-off, which evaporates some unrealized profits is

not a reason to throw in the towel. Many traders might have tempted to close

dollar longs today, if they did, they have got spun around and “realized” their

losses. Granted, anything could have happened, the dollar could easily have

continued lower, luckily is has not.Â

In summary, my views and rationale for the trades

were tangible and made sense, and they still make sense now. This is why I

simply do not issue trading recommendations without a healthy dose of discussion

as to my reasons for taking the trade, this seems to resonate with traders who

view such services. So despite a minor set-back last night, the outlook still

seems to be dollar favorable.Â

As always, feel free to send me your comments and

questions.

Â