Managing Rapid Fire Change & 3 PowerRatings Short Stocks

Change is the only constant in the stock market. The last several days have proven this maxim beyond a shadow of a doubt. Optimism in the financial media turned pessimistic on a dime. A radical sea change occurred within 48 hours despite plenty of good news from the corporate front.

This rapid fire regime change is nothing new in the financial markets. In fact, it’s de rigueur. When things are looking super positive with a major drop seemingly light years away, this is when the drop happens. Ultra optimism generally precedes market routs. The opposite is also true. Just when everyone believes it’s impossible for the stock market to rebound, a new bull phase begins.

Traders and investors who understand this dynamic have a psychological edge when actively participating in the market. The market appears to be designed to catch as many players off guard as possible to extract the maximum amount of capital. The ability to manage this rapid change both psychologically and practically is a key trait of top earning traders/investors.

First, expecting the change when it’s least expected by the majority offers a psychological advantage. Secondly, the ability to dump/hedge losing positions immediately either by fixed price/percentage stops or having a hedging plan in place is a strategic way to deal with rapid changes. Third, using proven stock picking tactics to locate shares objectively most likely to profit in the short term can potentially insulate you from the rapid changes of the overall market.

With this in mind, we have developed a proven 3 step strategy to locate those companies most likely experience short term price drops regardless of what happens in the market as a whole.

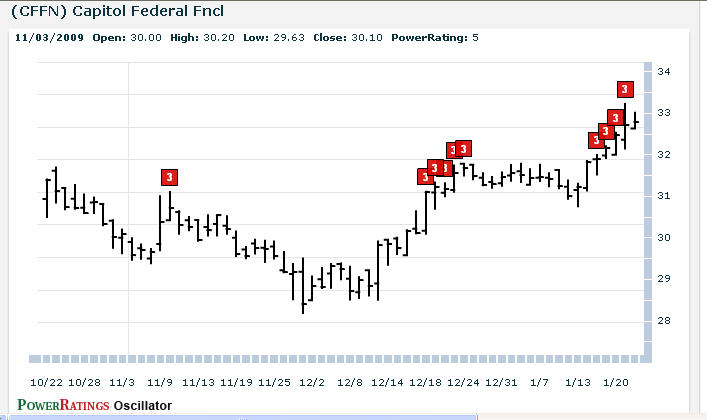

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this doesn’t seem to make initial sense. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names ready to dip after being higher:

^CFFN^

^FCF^

^UCBI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.