Managing the Rate Increase & 5 PowerRatings Ready to Fall

They finally did it. After years of speculation, innuendo and rumors, the Fed actually made a move in that most holy of holy area, interest rates. Certainly nothing drastic, saber rattling or earth shaking but still movement has occurred.

For the first time in 3 years, the Fed raised the discount rate 0.25% to 0.75%. It was a surprise action that caught most traders and investors off guard. However, Pimco’s chief, Bill Gross, believes the move was telegraphed but most of us mere mortals missed that signal!

The Fed showed some kindness by waiting until the stock market closed to reveal the surprise. Needless to say the stock futures immediately dropped sharply while the U.S. dollar roared higher against most of its paired partners. In a last second attempt to mitigate the damages, the Fed stated that this move should not be taken as a signal that further tightening is in the near term cards. That they are merely looking to normalize their lending facilities not cause disruption.

Fortunately, future traders bought the Fed’s reassurances leading to quick rebound after the opening bell. As short term traders, we need to be prepared to take advantage of these types of shocks to the everyday operating routine of the market. The buying of weakness after the interest rate driven slide is a classic example of profiting from entering a trade on weakness and not strength. The opposite also holds true, the shorting of strength makes more sense than the shorting of weakness.

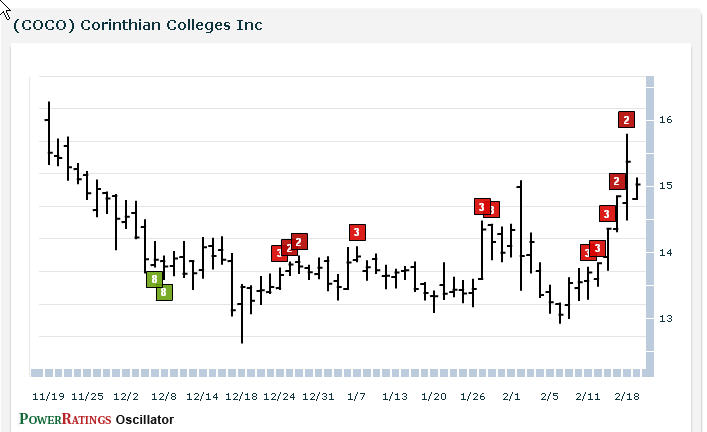

As you know, the market remains in overbought territory with many individual names giving strong short signals. Our stock PowerRatings is one way for you to identify which companies are primed for a short term drop. The Stock PowerRatings are a statistically based tool that is built upon 15 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

Here are 5 of the lowest ranked PowerRatings stocks for your selling/shorting consideration:

^JTX^

^MCS^

^ASTE^

^CXW^

^COCO^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.