Market Momentum Movers & 3 PowerRatings Stocks

This will be a very interesting shortened trading week. The Good Friday Holiday will be closed for stock trading. However, the S&P Futures will trade until 9:15 AM.

What makes this week unique is the most anticipated economic event of the month, Non-Farm Payrolls, occurs at 8:30 AM Friday to a closed stock market. While the futures will be open for a short time after the release potentially providing a better than usual read-on-opening action for Monday.

Stock investors should constantly be asking the question, “What are the current market momentum movers?” Presently, there are 3 key market momentum movers in play. These are, in order of importance, interest rates, employment, and the international debt situation. Let’s take a closer look at each of these stock market critical factors and talk about how they may play out in the near future.

Interest rate increases are signaled by demand for U.S. Treasury Notes or T-Bills. The 2-year, 5-year and 7-year Note auctions last week clearly indicated that demand is weakening. The weak demand triggered rising yields and falling bond prices. In fact, yields are now at the highest level since 2008.

Obviously, rising bond yields and rising stock prices reflect that investors are optimistic about the future. This optimism, if it lasts, could easily lead to inflation fears forcing the Fed to raise rates. Many analysts believe that investors can expect continued increased interest rates despite Fed rhetoric to the contrary.

The employment situation is improving. The majority of prognosticators are expecting an improved showing at the Non-Farm Payroll release Friday. 200k new jobs and the unemployment rate unchanged from 9.7% is the forecast. It looks like this stock momentum mover may trigger further upside in the market. However, always be ready for a surprise when it comes to the employment numbers. I don’t think we are fully out of the woods just yet.

International debt is the clear completely unknown factor. It is the clear wild card within the 3 main market momentum movers. While things appear to be improving in Greece, almost every week, rumors of another sovereign crisis rises its ugly head.

We can anticipate that the IMF and/or the EU will step into the fray to assist in most cases. However, the unknown factor of just how this international situation will play out is a negative on the stock market’s upward momentum.

Of course, all investors should pay attention to these 3 market momentum movers. They are perhaps least relevant for short term stock market traders. Short term traders look for individual names that have pulled back and are ready for a quick advance.

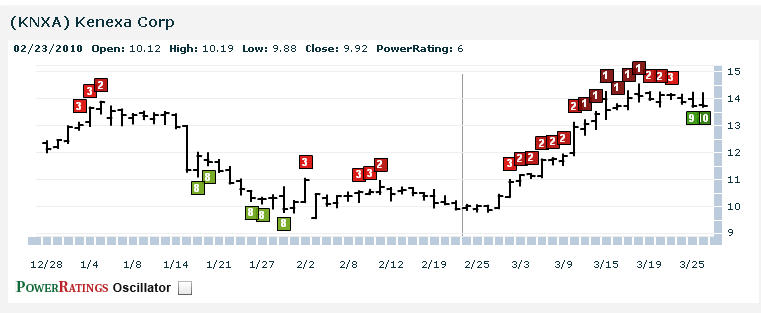

Our stock PowerRatings is one way to locate these companies ready for a fast pop regardless of the macro picture. Here are 3 top ranked PowerRatings stocks:

^CKE^

^MDTH^

^KNXA^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.