More Moon

It looks

like the Full Moon day was exactly

that — a specific mission. The 2409-2531 rally in the Nasdaq 100

(

NDX |

Quote |

Chart |

News |

PowerRating) was

5% and was halted at a geometric retracement point relative to the 2627 high on

Feb. 1 (see your five-minute charts). This was a good pop from the .50

retracement zone on the daily chart. It declined to 2349 or the .618 level on

Wednesday, then rallied into that close, then carried over yesterday morning to

a 2464 high. That was a 4.9% rally and stopped on the number — framed from

2531-2350. The decline from the

10:30 a.m. bar took the index down to a 2356 close.Â

The sell side game plan for

the NDX today is as follows:

-

Continuation short

below yesterday’s low of 2350. The decision is to cover and go long if it

reverses the low and/or play again on the short side if the NDX breaks 2350

on second entry — and that’s assuming we get a contra rally if the retail

have to sell at the market makers’ discount on the opening. My next alert

levels are the extension legs at 2319, 2280 and then the .786 level of 2234.

Percentage-wise, it is only -1.5%, -3.2% and -5%. -

You then calculate

your Volatility Bands, using 52.07 as the combined Implied Volatility. You

get the 1.28 band at 2274, the 1.5 at 2259 and the 2.0 at 2227. You now have

an idea of the convergence between the 2280 extension leg and the 1.28 band,

in addition to the .786 level at 2234 and the 2.0 band of 2227. -

Having done this, you

can now focus on the market dynamics in those stocks you are trading. These

are alert zones where you look for a Change of Direction pattern to develop,

such as the lay up on Wednesday. -

When you get a

reversal pattern in the index, you will get entry patterns in various

stocks, so keep scrolling. In the S&P 500

(

SPX |

Quote |

Chart |

News |

PowerRating), the first two

extension legs are 1.27 at 1330 and 1.618 at 1324, while the 2.0 extension

leg is 1318, which converges with the .50 retracement on your daily chart,

which is also 1318. The SPX closed at 1332.53, with a low of 1332. The

volatility bands are 1.28 at 1316, 1.5 at 1313 and 2.0 at 1306.The .618

retracement of the recent rally is 1303 on your daily chart. The combined

Implied Volatility you use is 18.85 which is on the low end.

Yesterday’s low in the Nasdaq 100

(

NDX |

Quote |

Chart |

News |

PowerRating) is a sitting duck for the program traders to leg a trade today and the

futures players to toy with. Translated,

it means that if an institution wants to sell the futures at 15 points (just to

pick a number) and buy the NDX 100 stocks, a program trader might stop the

institution at that spread and then he can work as agent, principal, or both, to

execute the program. If he does better than 15 points, he will usually get part

of the overage.

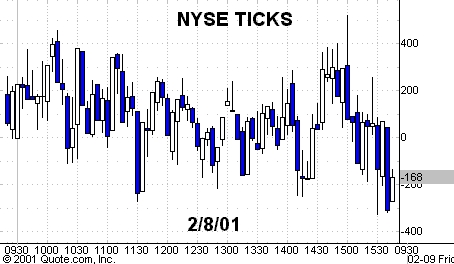

If we stay red early today,

the program trader looks at the 2350 low and says it is a good inflection point

which will bring in selling and set off stop orders if broken. What he can do —

and he is at risk — is to start the snowball rolling by leaning on the futures,

which forces the break and brings in more sellers as the NDX stocks

decline.Â

His bet is if he legs the

sale of futures and stocks decline, breaking the lows, he will be able to buy

the stocks lower. So, maybe he has done the trade at, say, 16.5 point spread,

which is more vig for him and the customer. If he legs the futures and is wrong,

he knows the worst case is that he can buy the trade from the customer at a 15

point spread. This is the reason you see so many Full Moon trades — it is an

absolute license.Â

Today is just an example of

a downside market game plan that you start the day with, but you must also go

through the S&P 500 and NDX 100 screens looking for daily chart setups so

you are prepared for whatever the market gives us today. Not

enough time here to do the upside, but you get the drift.

|

(March

|

||

|

Fair Value

|

Buy

|

Sell

|

|

6.40

|

7.70Â |

5.10Â

|

Stocks today: Really not

focused on them — only focusing on the

(

QQQ |

Quote |

Chart |

News |

PowerRating)s and the SPDRs — and if they

go south on the Semis (which have retraced a half to two-thirds of their recent

rallies and they acted well early yesterday).

Have a good trading day.