Nasdaq Trading Strategies: 3 Oversold Stocks for Traders

Nasdaq stocks were advancing for a third day, driving the index deeper into overbought territory below the 200-day moving average.

When stocks, ETFs or entire markets begin moving aggressively higher, it is a natural reaction for traders and investors to become excited about the possibility of still higher levels. However, when those stocks, ETFs or entire markets are trading below their 200-day moving averages, traders and investors tend to be better off exercising caution.

Our research indicates that consecutive up days below the 200-day moving average are more a cause for concern than celebration. Although the Nasdaq will only make it a third consecutive up day should buyers stay in control on Wednesday, our work tells us that now is not the best time for short term traders to be aggressively long.

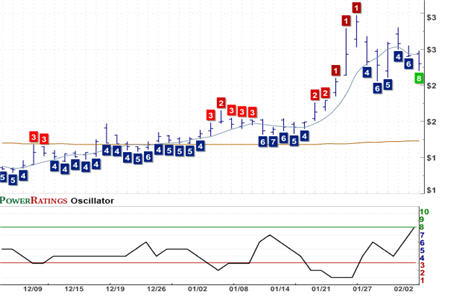

Trico Bancshares

(

TCBK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 19.25

That said, there are a few Nasdaq stocks that remain at depressed levels, still under the control of sellers, that have the sort of high Short Term PowerRatings that have historically led to higher levels in the near term.

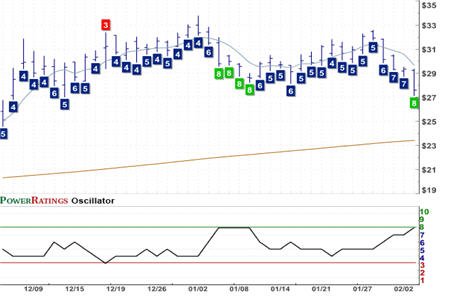

Thoratec Corporation

(

THOR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 2.57

The PowerRatings and 2-period RSI values shown here are as of the Tuesday close. In the first few hours of trading on Wednesday, all three of these stocks have moved lower. This may or may not mean that PowerRatings upgrades are in store. But it does mean that the 2-period RSIs on these stocks are dropping, revealing the stocks to be all the more oversold and all the more likely to respond positively when buyers return.

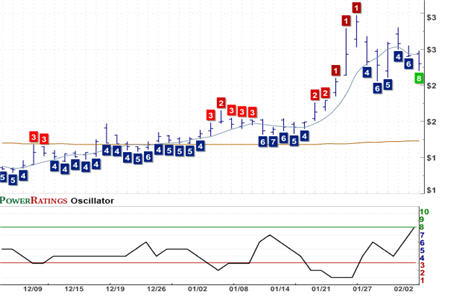

Stem Cells Inc.

(

STEM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 18.54

All the stocks in today’s report have Short Term PowerRatings of 8 or 9. Stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days. Stocks with Short Term PowerRatings of 9 have fared even better, besting the average stock by a more than 13 to 1 margin over the same time period.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.