Nasdaq Trading Strategies: 3 Stocks for Swing Traders

Stock futures pointed to a big open in trading on Tuesday. At one point in the hour before the bell, Dow, S&P and Nasdaq futures were up more than 4%.

Now, 90 minutes after the bell, all three major markets are far closer to breakeven — though the Dow remains relatively resilient.

This shouldn’t be a surprise to anyone. Last night on Bloomberg TV, one commentator suggested that anyone over 50 with money in the stock market will be selling at every opportunity “for the next six or seven years.” The only question, he added, was whether or not they would be smart enough to sell on rallies.

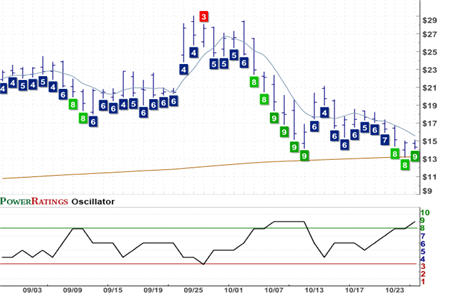

Thoratec Corporation

(

THOR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 1.16

This is not the best backdrop in the world against which to be buying stocks for most traders. But swing traders can improve their odds by following a discipline that only takes long positions when stocks are down — instead of trying to ride momentum higher on those occasions when stocks are moving up. We are not big fans of momentum trading in stocks generally speaking. But we are especially adverse to this strategy — at least to the long side — in markets that are under tremendous pressure

Corinthian Colleges Inc.

(

COCO |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 6.15

The Nasdaq is very oversold — more so than both the Dow industrials and the S&P 500. This means that the Nasdaq is one of the places where swing traders should look for potential trades: stocks that are above their 200-day moving averages, but have been dragged down by the pessimism, fear and uncertainty that has characterized the market for all stocks over the past several weeks and months.

Sequenom Inc.

(

SQNM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 1.57

To be sure, the ranks of such quality pullbacks are not broad. But these opportunities do exist. Here I have noted three stocks: all Nasdaq stocks with Short Term PowerRatings of 9, all trading above their 200-day moving averages, all with the potential to move higher in the near term. If you are looking for stocks with the capacity to outperform the average stock, then these three stocks are a worthwhile starting point.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.