Nasdaq Trading Strategies for Bulls and Bears: QID, PSQ, NCIT, ICFI, GTCB

Do you think the Nasdaq is going up or going down?

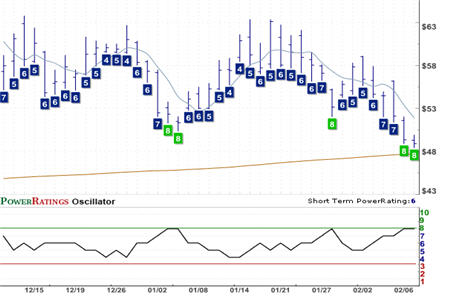

ProShares UltraShort QQQ ETF

(

QID |

Quote |

Chart |

News |

PowerRating)

Regardless of what you think the short term direction of the Nasdaq will be, our Short Term PowerRatings are pointing to opportunities for both Nasdaq bull and Nasdaq bears right now.

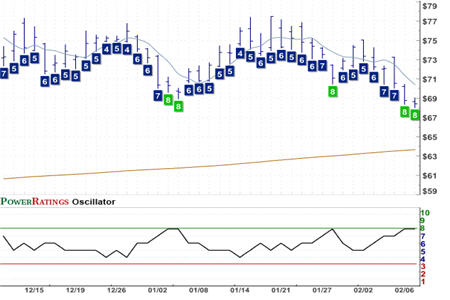

ProShares Short QQQ ETF

(

PSQ |

Quote |

Chart |

News |

PowerRating)

Let’s take a look at the bearish case first. Above, I’ve posted two PowerRatings charts of short ETFs linked to the Nasdaq 100. The top most chart is of the ProShares UltraShort QQQ ETF, QID, and the second chart is of the ProShares Short QQQ ETF, PSQ.

In both cases, we have two ETFs with high Short Term PowerRatings of 8. While this is a good PowerRating for stocks, we have found PowerRatings of 8 to be particularly worth noting when they appear next to short exchange-traded funds. Consider, for example, the way both QID and PSQ have responded in the days after earning Short Term PowerRatings upgrades to 8.

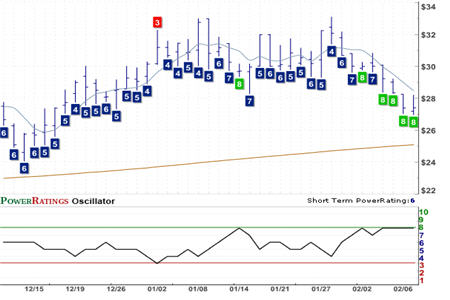

Traders who are instead looking to the Nasdaq for more upside will be heartened to see a few Nasdaq stocks trading above their 200-day moving averages with high Short Term PowerRatings of 8 or better. First up is NCI Inc.

(

NCIT |

Quote |

Chart |

News |

PowerRating), which has a Short Term PowerRating of 8 and a 2-period RSI of 2.66 (above).

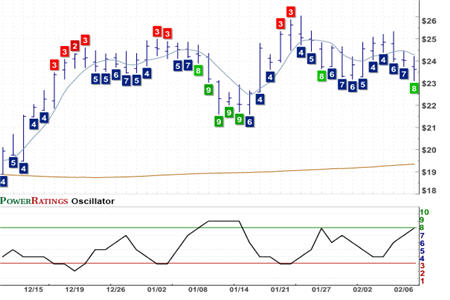

Another option for Nasdaq traders looking for stocks with upside is ICF International

(

ICFI |

Quote |

Chart |

News |

PowerRating). This stock (chart below) also has a Short Term PowerRating of 8 and a 2-period RSI of just over 8.

Last but not least (below) is GTC Biotherapeutics Inc.

(

GTCB |

Quote |

Chart |

News |

PowerRating). In addition to having a Short Term PowerRating of 8, GTCB has a two-digit, 2-period RSI of just under 17.

Stocks with Short Term PowerRatings of 8, according to our research into short term stock price behavior since 1995, have outperformed the average stock by a margin of more than 8 to 1 after five days.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.