Nasdaq Trading Strategies: Overbought ETFs and Oversold Stocks

Stocks are mixed in the first hour of trading on Monday, with the Nasdaq, Dow and S&P 500 all trading about 1% down for the session.

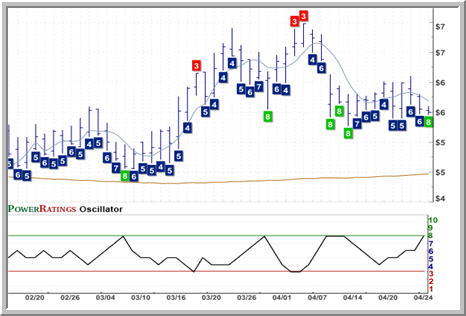

Let’s take a special look at the performance of the Nasdaq and Nasdaq 100 today, both in terms of the ETFs that represent the Nasdaq 100, as well as some of the higher PowerRating stocks that are a part of the Nasdaq.

With regard to both the PowerShares QQQ Trust ETF

(

QQQQ |

Quote |

Chart |

News |

PowerRating) and the ProShares Ultra QQQ ETF

(

QLD |

Quote |

Chart |

News |

PowerRating), we see that the Nasdaq 100 is significantly overbought. Both the QQQQ and the QLD entered overbought territory late last week and have only become more overbought in the intervening days.

Conversely, short (or inverse) ETFs for the Nasdaq 100 have continued to experience heavy selling pressure. The ProShares Short QQQ ETF

(

PSQ |

Quote |

Chart |

News |

PowerRating) and the ProShares UltraShort QQQ ETF

(

QID |

Quote |

Chart |

News |

PowerRating) have both closed lower for the past four days leading into Monday’s trading and are extremely oversold below the 200-day moving average.

What does this mean for traders of oversold Nasdaq stocks?

Encore Wire Corporation

(

WIRE |

Quote |

Chart |

News |

PowerRating) PowerRating 8. RSI(2): 2.72

Nasdaq stocks as a whole are likely to move lower in the near term, given the exceptionally overbought nature of the Nasdaq. This means that a number of stocks in the Nasdaq that already have been pulling back and developing high PowerRatings may move even lower in the next few days, providing potentially even better entries for trading strategies like ours that rely on buying weakness and selling strength.

Tractor Supply Company

(

TSCO |

Quote |

Chart |

News |

PowerRating) PowerRating 8. RSI(2): 19.46

Included in today’s report are a few stocks that short term traders might want to keep an eye on for intraday weakness over the next few days. Note that all of these stocks have PowerRatings of 8 which, according to our research, puts them in that category of stock that has outperformed the average stock by a margin of more than 8 to 1 after five days.

Big Band Networks Inc.

(

BBND |

Quote |

Chart |

News |

PowerRating) PowerRating 8. RSI(2): 18.81

Find out about the performance of high PowerRatings stocks in Larry Connor’s primer, PowerRatings Does it Again — Results for 2008.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.